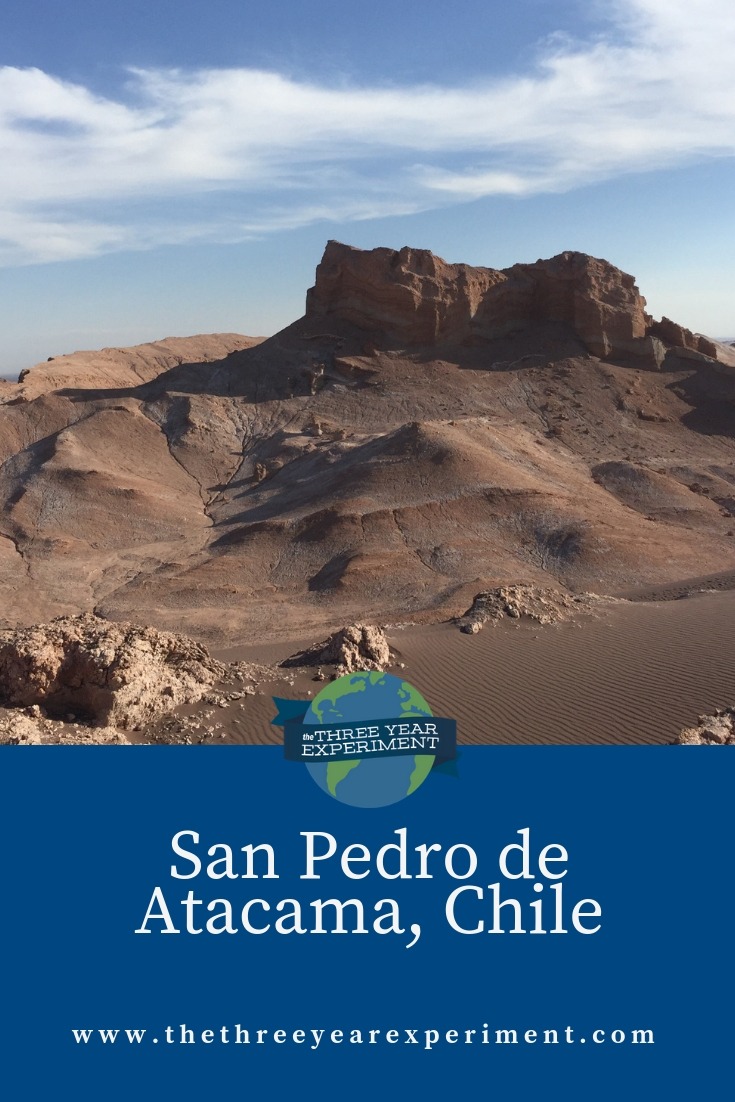

Hello readers! The ThreeYears are currently in Santiago, Chile, for Christmas and New Year’s. It’s summer here, so the weather is hot. Our family of four has been busy visiting family, traveling to the driest desert in the world, and generally enjoying ourselves.

Santiago is a city of about 6 million people, roughly one third of the total population of the country, located in the very center of the long and narrow string bean that is Chile. It’s nestled in a valley between several mountain ranges–the Andes to the east (mountains known as the Precordillera–not quite as tall as the Cordillera of the Andes a few kilometers away) and the Chilean Coastal Range to the west. More mountains, a small range called the Cordón de Chacabuco, which is part of the Andes, are to the north, and to the south, there’s the Angustura de Paine, another thin mountain range that extends toward the coast. So there are giant mountains everywhere you turn. It’s one of the reason people hypothesize that Chileans are want to end so many words in “ito,” the Spanish ending that makes things little, because when you’re constantly staring at giant mountains everywhere you go, you feel smaller.

Santiago is organized into neighborhoods, or comunas. There are 37 official comunas in the city, and some (the best neighborhoods) extend into the foothills of the mountains that surround the city. Those neighborhoods can get to around 1,000 meters in elevation.

Santiago has a thriving economy that leads Latin America–its economy is the second most competitive in the region. The Economist Intelligence Unit ranked Santiago the second best city in which to live in Latin America, after Buenos Aires.

For this reason, immigrants have flocked to the country in the last two years. Continue reading “Notes from Chile: Entertainment and Food”