Ahh, a brand-new year. There’s something so beautiful in the promise of the next 12 months, yet unfettered by mistakes or regrets. I am, without a doubt, a goal-oriented individual. Mr. ThreeYear eye-rolls, my family cringes, but I absolutely love setting and achieving goals. Last month, when we’d paid off our two outstanding debts, it felt so good to feel the finality of all that hard work and singular focus. And it feels really good not to have those payments coming up this month.

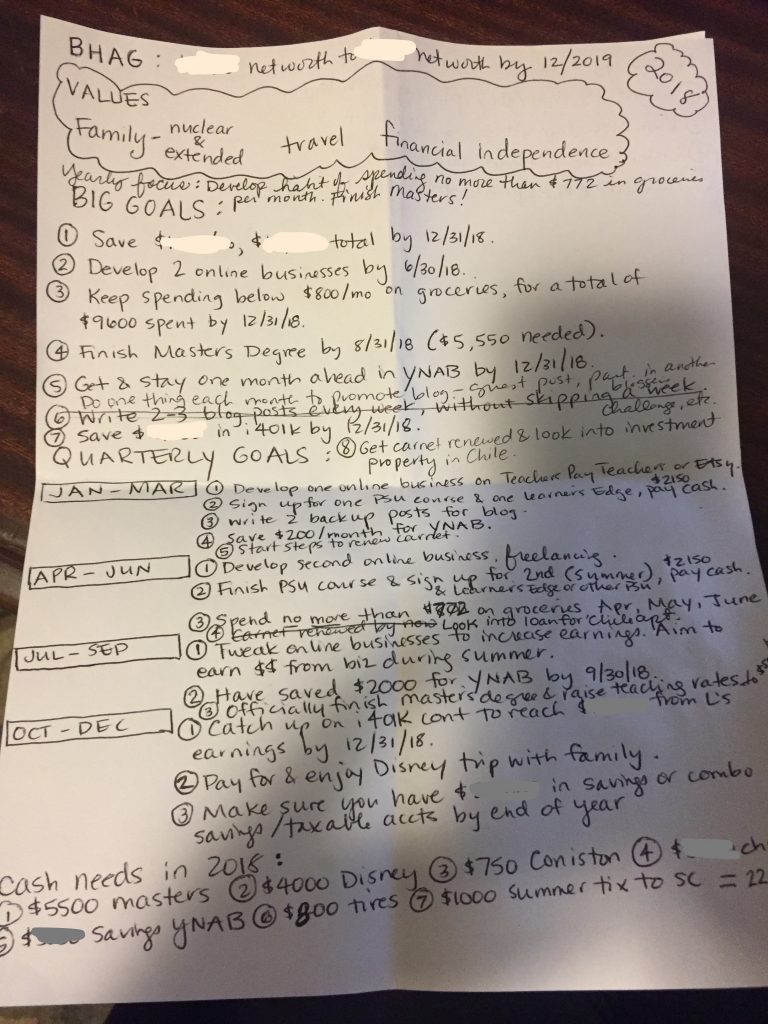

My 2018 Goal Sheet

As I did last year, I have a Goal Sheet for 2018. And like last year, I’ve followed a similar format to setting up my goals, with one notable exception (or addition, I should say).

I’ve created a hybrid approach to goal setting, based on several different strategies I’ve read about. This is how I currently write goals.

First, I take a sheet of white 8.5” by 11” paper, and at the top I write my BHAG (see above picture). This doesn’t change—it’s my long-term, three-year goal.

BHAG: Double our net worth by 12/2019.

Next is my Yearly Focus. This is what my biggest yearly goal will be. For 2018, my yearly focus is to develop the habit of controlling our grocery spending and to finish my Masters (I’ve been dragging my feet).

I’ve tried, and failed, for as long as we’ve been tracking our spending, to get better at grocery shopping. I’ve tried shopping once a month (hard!), shopping every two weeks, once a week, buying exclusively at big box stores, buying exclusively at Market Basket (our discount supermarket 45 minutes away), and nothing has brought our grocery spending down. It’s now or never. If we fail this year, I’m throwing in the towel and not worrying anymore. But I have a feeling we can hit this goal!

To finish my Master’s, I have four more classes to take. I hate paying for them so I’ve been dragging my feet. But I need to finish this year. It’s time.

The next section is Top Values. I create a big balloon with my top values, so I can remember why I’m doing all this.

3 Top Values:

- FAMILY (nuclear & extended)

- TRAVEL

- FINANCIAL INDEPENDENCE

These are the same top values from last year, but we have added that for us, family means our nuclear family and our extended family. Much of the travel we do involves extended family, which is a win-win.

There is an inherent contradiction in spending between travel and financial independence, but then again, F. Scott Fitzgerald tells us that “The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.”

The cognitive dissonance that the values of travel and financial independence bring is something we constantly grapple with. When is travel worth the money? When isn’t it? How will it affect our financial independence? We value one, and we value the other. It’s messy, but that’s life.

Next, I write my main goals in the next section.

My Big Eight 2018 Goals Are:

- Save $XXX per month, $XXX total by 12/31/2018. This is the money we’re able to save by not having any more payments.

- Develop two online businesses by 6/30/2018. Last year, I drug my feet with doing anything for pay on the internet. I’m not sure why. I think I was afraid to add one more thing and derail my focus, which is a fair concern. This year, I think it’s a more reasonable goal.

- Keep spending below $772/month on groceries, for a total of $9600 spent by 12/31.

- Finish Master’s Degree by 8/31/18 ($5,550 needed).

- Get and stay one month ahead in YNAB by 12/31/2018.

- Do one thing each month to promote blog–guest post, blogger challenge, etc.

- Save $XXX in i401K by 12/31.

- Get my Chilean National Identity Card renewed and look into investment property in Chile.

This last goal is something that came up when we were in Chile. One of Mr. ThreeYear’s friends shared that he owned several apartments that were investments for him. Since we’ve just paid off our apartment, we realized we could probably get another (small) loan from my bank and buy a property in our same building that we could rent out. It would bring in a small positive cash flow after covering the mortgage. I have thought that Santiago’s property values were in a bubble for years, but over the past two visits, I’ve realized I could be wrong–values could be rising because of income and population increase. Even if property values were in a bubble, would it make sense to buy a property? Since we know the building we’re looking at, and the vacancy rates, I would answer a cautious “yes” to that question. People really like to rent in that particular building. The most important question: could we afford to hang on to the property if it sat vacant for awhile (or could we afford to drop the rental price)? Yes, we could. I’ll keep you posted on what we decide.

Finally, the last section of the sheet is for Quarterly Goals. This is where I break down how I’ll achieve the Big 8 goals each quarter. Breaking it down makes it so much easier for me to assess, during the year, if I’m making progress on my goals and/or if I need to make any mid-course corrections. In theory, these goals should reinforce the big 8, or at least be in line with our top values.

JANUARY to MARCH:

- Develop one online business on Teachers Pay Teachers or Etsy.

- Sign up for one Master’s course and one online course, pay $2150 cash.

- Write 2 backup posts for blog.

- Save $200/month for YNAB.

- Renew Chilean identity card.

APRIL TO JUNE:

- Develop second online business (freelancing?)

- Finish Master’s course and sign up for 2nd course, plus one online course, pay $2150 cash.

- Spend no more than $772 on groceries for April, May, June.

- Look into loan for Chile apt.

JULY TO SEPTEMBER:

- Tweak online businesses to increase earnings. Earn $XXX from businesses during July, August, September.

- Save $2000 for YNBA by 9/30/2018.

- Officially finish Master’s degree and raise teaching rates to $XX.

OCTOBER TO DECEMBER:

- Catch up on i401K contributions to reach $XXX from my earnings by 12/31/2018.

- Pay for and enjoy Disney trip with family.

- Make sure to have $XXX in savings and taxable accounts by end of year.

I also added two new sections. One is called Cash Needs in 2018. This section will help me plan how much we need to spend in cash for each of our big trips, goals, or plans.

The other new section is called Habits to Improve–I wrote these on the back of my goal sheet. These are habits I want to focus on improving and mastering in 2018. Right now, there are four habits I’ve written down:

- Spend 15 minutes a day playing with kids.

- Run every day first thing, at least 10 minutes.

- Listen more without judgement.

- Speak in Spanish more with the kids.

While these aren’t goals, per se, they’re reminders of behaviors I’d like to be working on during the year. They’re the most important things for me, apart from these goals, so I’d like to have a reminder of these intentions in a place where I’ll run into them often.

Why These Goals for 2018?

A lot of the goals we have this year are focused on saving and a few are focused on earning more (finishing my Master’s will allow me to charge a higher hourly rate). Creating online businesses will help build more income streams for us that are not dependent on location–the investment property in Chile will eventually do the same, as well.

This is the year when we’ll really have to ramp up our savings rate in order to meet our net worth goal, because we cannot always count on boosts from the stock market like we enjoyed in 2017 (we just hope 2018 won’t bring a precipitous dip, but that could happen, too). If we’re able to achieve these goals, I suspect we’ll be able to save a lot more than we did last year, and of course bring our spending down as well. That will really help us do our best to reach our net worth goal in 2018 and get just a little bit closer to location independence.

So how about you? Got any big goals for 2018?

Great goals! Grocery spending is always a pain for me too. I’ve succeeded before in driving it low, but it takes a lot of effort. Best of luck!

Thanks Liz! It’s definitely one of our highest spend areas. We’re going to give it our best shot this year and see how we do!

Big goals going on for you this year, I like it. Sounds like finishing the Master’s degree will pay off. Good luck!

Thanks Amy! Lots of big ones this year. 🙂 I sure hope so!