Everyone wants the magic formula, the hat trick, the secret, to becoming wealthy. And no, it’s not “you attract to you what you think about.”

The golden rule of building wealth is simple. It’s so simple, it’s been repeated ad infinitum by the personal finance community, financial planners, and people who actually have wealth.

It’s been systematically attacked, hacked, subjugated, by practically every other entity in our society.

Ready? Here it is: spend less than you earn.

Oh, and we can’t forget the corollary: invest the difference.

Boom. We’re done.

Oh, if only, dear reader. If only it were that simple. If only I hadn’t felt dread course up and down my body yesterday as I calculated how much we’ve gone over budget in March. If only Payday Loan Centers didn’t sprout like fire ants across the small rural communities of this country.

If only we didn’t have the hear the siren call of advertisements fill our every waking moment, to peruse the endless streams of social media promising you’ll be better, faster, and stronger, if you click here and buy it now.

Spending less than you earn, as simple as it sounds, is one of the hardest things to do as a human being living in our modern (especially first world) society. It involves saying “no” one hundred, one thousand, ten thousand times per day to what can feel like everyone and everything around you. It involves staying true to a distant goal for a distant self, living like you’re in a different economic class, developing copious amounts of will power over time, and not letting it all fall apart if your life becomes unglued, through death, divorce, or some other tragedy.

It sometimes feels like an impossible task. And yet, people accumulate wealth every day. People save; people retire; they pay off their mortgages.

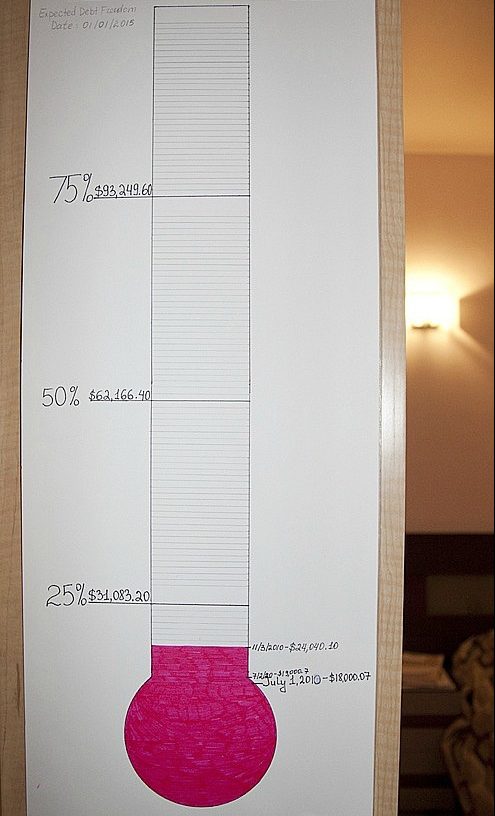

In my experience, as a reformed spend-a-holic, we’ve been able to slowly accumulate wealth in the face of all these temptations because of a couple of behaviors that have allowed us to practice “The Golden Rule of Building Wealth” while still existing in a consumerist society.

Continue reading “The Golden Rule of Building Wealth”