As I mentioned in my last post, this year I’m not setting goals like I have in the past. One of the reasons for this is because I’ve achieved a lot of my short-term and mid-term goals, especially the big ones (become location independent, fully fund our 401ks, get a job, get a dog).

This year, I’m more focused on tweaking the little, day-in and day-out habits that ultimately make life better or worse.

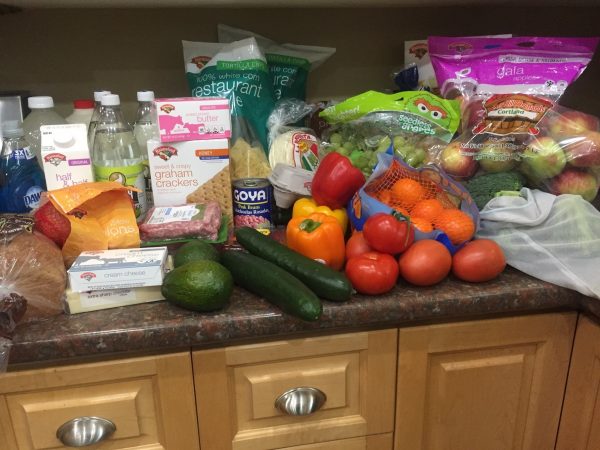

One of those habits that I’m tracking is how many vegetarian meals I eat per day.

Why am I tracking vegetarian meals? I’ve been an avid meat consumer since birth, and I’ve never, absolutely ever, been tempted to become a vegetarian or go vegan.

However, I’ve realized for some time that eating less meat is good for the planet, and recently, I read the book Blue Zones Kitchen, which convinced me that eating more veggies is good for my body, too.

I’ve talked about the book before. It’s a cookbook written by Dan Buettner, the National Geographic researcher who coined the term “blue zones,” areas of the planet where the local populations live, on average, ten years longer than the people around them. No one knows exactly why that is–it could be close knit relationships, their propensity to move more throughout the day, diet, or a combination of many things (which is probably the case).

Continue reading “Why We’re Eating More Vegetables in 2020”