I’ve written a lot about how we teach our kids about money and tackle allowance in the ThreeYear household, but I have a confession to make: I’m really terrible at remembering to get cash from the bank to give my kids.

Isn’t that always the way? If there’s a tiny kink in your process, such as your bank being too far away to go get cash, then it can throw the whole process awry.

For the record, our allowance plan is supposed to look something like this:

- Kids do weekly chores and help around the house.

- Kids are given $6 each in cash.

- Kids save $2, set aside $2 for Giving, and have $2 to spend.

- Kids save up for toys they want, learning valuable money lessons like patience and perseverance in the process.

In reality, it goes something like this:

- Kids occasionally do chores when I make them.

- Kids complain that they haven’t received their allowance in months.

- I realize that, in actuality, it has been months since I’ve given them their allowance.

- I give myself a talking-to about setting a good example and following through.

- More months go by and I don’t give them their allowance.

Here’s why I think it’s important to give kids allowance. I believe that unless children have a chance to use money, they won’t understand how it works, and it will continue to be an illusive substance over which they have no control. Once they get the chance to use, and, yes, even make mistakes with their money, they’ll have a much better idea of the value of a dollar and understand better how to budget.

So the fact that I’m so bad at giving out allowance, because I never have cash, means I am missing out on the chance to give them valuable money experiences.

Related Reading

- How to Communicate with Your Kids Without Using Cell Phones

- Changing Your Kids’ Money Emotions

- What We Teach Our Kids About Money

My Story

When I was growing up, I was a kid who constantly begged my parents for stuff. Despite the fact that we grew up in an upper-class household, I didn’t constantly get everything I wanted (thank goodness). I wore hand-me-downs and watched my mom make do with what she had instead of buying something new (hello, 1970s-era kitchen appliances). But I did apparently drive her crazy when we’d go to the mall (I date myself) and I’d beg her to buy me everything in sight. I was never satisfied.

Enter Mr. Bell, my seventh grade social studies teacher. One day in class, he explained that he gave his kids (who were a few years older than me) a generous allowance each week, but required them to buy everything they needed for themselves. That meant books, school supplies, clothes, school lunch.

This idea sounded amazing to me, so I went home and proposed this option to Mom and Dad. Somehow, perhaps because the demanding-stuff-at-the-mall situation was untenable, they agreed, and Dad took me to the DMV for an ID and to the bank to open my very own checking account (again, I date myself).

They set it up so that I got a paycheck (Dad owned his own business) each week for $25, and the deal was that I would need to pay for everything myself. I began to write checks for lunch money, save up for a jacket I really wanted, and otherwise begin to learn how money worked.

I remember being very annoyed at having to spend my precious allowance dollars on lunch money. Still, I never skipped lunch, so I had to make sure to save enough for that.

In short, that system worked through college, and I owe a great deal of the (albeit limited) financial restraint I have today to managing my money since age 12.

Times Have Changed

Back to 2020. As I bemoaned my lack of accountability with the kids’ allowance, I took a scroll through Facebook (something I do less and less after this experiment) and saw an advertisement targeted for me. It was a debit card for kids, that parents could load with money, and it even had buckets for saving and giving.

I decided to check it out. The debit card is called Greenlight, and it’s one of several debit cards currently on the market designed for kids.

Here’s how it works. When you sign up for the service, each child receives a debit card with their name on the back (they can also get personalized ones for $10 more. No for us). The parent downloads the Greenlight app and puts an amount of money in your “Parent Account.” The service transfers the money directly from your bank. Then, you set up a profile for each child, up to 5. You can set a Weekly Allowance and specify how much of their allowance goes into each of their buckets. They have a Spending bucket, a Saving bucket, and a Giving Bucket.

The cards work exactly like a debit card. You set up a pin, and your kids can use the debit cards in stores. The service costs $4.99 per month inclusive of 5 children.

I decided to give the service a try. Yes, it costs money, but it allowed me to start giving them allowance automatically.

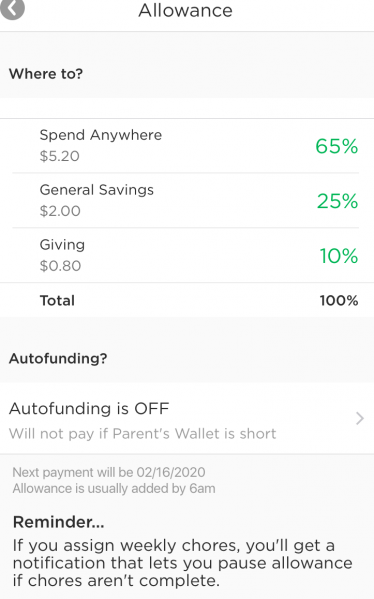

When the debit cards arrived in the mail, my older son set up the Greenlight app on his phone (we got him a phone at Christmas–I need to write a post on why that happened) and can see his weekly allowance divided into Spending, Saving, and Giving buckets. Currently, he receives $8 per week (a lot less than I got! I need to probably rethink this) and can spend 65%, or $5.20 per week, must save 25%, or $2 per week, and has 10%, or $.80 to give per week.

The cool thing about the saving bucket is that Greenlight automatically adds interest (from your Parent Account) to the savings each week. They add something like 10% interest each week, an amount that’s enough that kids see the power of saving pretty quickly. Junior ThreeYear is already asking when his interest is going to appear in his account.

The kids have to complete weekly chores in order to get their allowance, so if they don’t, I can stop or delay their allowance.

Yesterday, Little ThreeYear asked me if he’d have to start paying for his weekly lemonade slushie that he gets after tennis practice (that sounds très bougie). I said I’d think about it.

Greenlight

Time will tell what the Greenlight debit card and service will teach my kids about money, but I’m excited we finally have a tool that helps me help them.

Have you ever used a service like this for allowance or teaching your kids about money? What did you think?

Our kids are legal adults now — ages 24 and 18 — and thankfully they are good with money though we didn’t too much structure, like allowance for chores or earmarked accounts. What we did do, that I think worked for them, was very openly discuss money. They know how much we make, where we invest, how we make spending and investment decisions (though they don’t show a big interest in numbers so probably don’t remember specifics). We opened Roth IRA’s for both as soon as they had income, and we required that they read a general personal finance book so they could have the concepts, and then we matched their contributions. I didn’t think my 16-year old was at all interested, but when she realized her sister was getting $5k for effectively reading a book, she begged to be included. She is short and baby-faced so looks more like 12 than 16, so people marveled at her on the subway, reading a fat hardcover by Suze Orman (the book I asked them to read was Orman’s “Courage To Be Rich”).