I started this blog almost a year ago to document our family’s journey toward location independence over three years. We picked a three-year time frame because it coincided with several significant events in our family’s life: our oldest son finishing sixth grade, my husband turning forty-five, and me turning forty.

We love to travel, and we also have family who live in two different continents, so becoming location independent would allow us to spend a few years, before our boys start high school, living in an international location, or traveling between our respective families for a few years.

In order to make our plan work, we decided we would need to double our net worth and find jobs that would support us during our travel time. While doubling our net worth could allow us to live on 4% of our investments at a certain spending level, we know that with our current spending plus the need to fund two college accounts, we would prefer to have employment during our travel years, preferably employment that provides health benefits.

While we’ve talked about other aspects of our plan, we haven’t delved into how, exactly, we plan to double our net worth. So I thought I’d walk through our plan in this post.

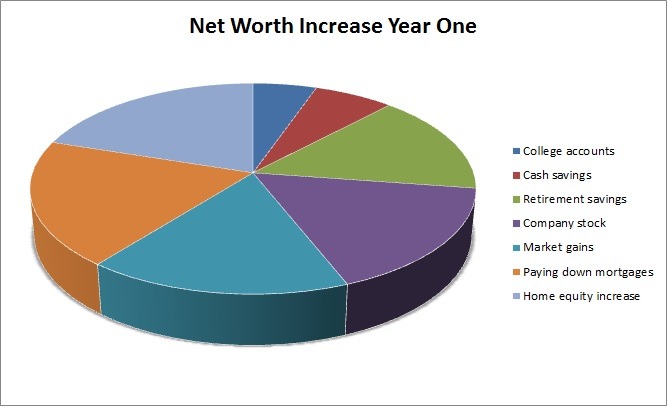

Year 1 (roughly 33% increase):

We have almost completed Year 1 of our Three Year Experiment. This year’s focus was on paying off the last of our debts and funding some major home repair projects, all while saving and investing to grow our investments and decrease our debts.

I don’t know if we’ll increase our net worth by the full 33.33% this year, but we’ll likely be close. Here is where the majority of the gain has come/will come from.

Retirement savings: 15.33%

Company stock: 16.67%

Paying down mortgages and paying off Prius: 19.33%

Market gains: 16.67%

Home equity increase: 20%

College accounts: 5.33%

Cash savings: 6.67%

One of our big goals this year was to pay off our apartment in Chile, so that’s why the “Paying down mortgages” category is high. That category is also where we accounted for the Prius payoff. As for our home improvement goals, we cash-flowed our roof replacement and other purchases from our income.

During Year One, large chunks of our gains have come from increases to our retirement accounts and the revaluing of our real estate holdings (okay, when I say “holdings” I really mean the house we live in and our apartment in Chile). While the gains from our retirement funds won’t help us during our travels, as we won’t be able to access them until we’re older, our real estate holdings will help us. We plan to sell our house in New Hampshire and put that money in taxable accounts. Also, there’s a good chance we will start renting out our apartment in Chile in the next few years. Based on its market value and the expected rental income, we’ll realize about a 5.5% net return on that investment. While our college savings won’t help us when we’re traveling, it’s an important part of our net worth because we want to save enough to pay for at least 75% of our boys’ education.

Funding Sources

We fund all of this savings with several major sources. One is Mr. ThreeYear’s income. He works in marketing in the manufacturing industry. He receives a biweekly paycheck, of which his 401K contributions are automatically removed. The rest of his paycheck is deposited in our Checking Account per our Simple Financial Management plan and used to pay bills.

The second is my income. My income is deposited into my business checking account (this is a change to our system as of September). I save 20% of my income in that account and also use that account to pay any business expenses I may have (buying books for students, prizes, etc.). The rest of the money is transferred to either our checking account, our savings account, or my i401K account. Notice I said “or.” This year, a lot of my income has gone to pay for our new roof and other expenses.

The third source of income is Mr. ThreeYear’s stock “gift.” Each year he is given a certain amount of company stock, which is guaranteed to be at least x% of his salary (it’s often more). Since his company is privately owned, an accounting firm performs an audit of the company once per year and the stock price for that year is set. If Mr. ThreeYear were to leave the company, he could take his stock with him (although there are some rules governing when and how much he can take).

We have several other sources of income, including a year-end bonus, cash gifts from family, and money we receive from various odd businesses (like translating, online skin care sales, selling things on eBay, etc.). All of our dividend income goes straight back into our investment funds. In the future, we may be able to include rental income from our Chile apartment to this list.

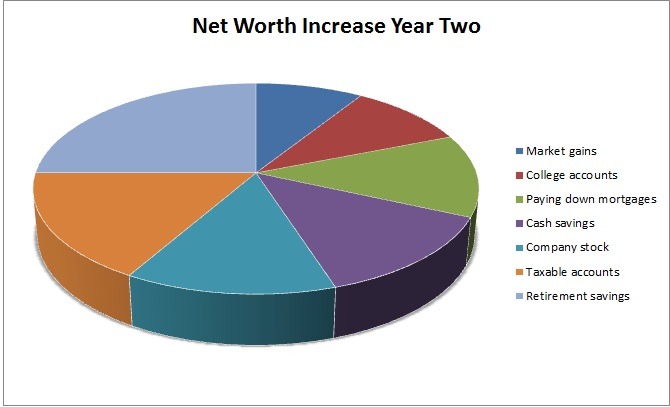

Year Two (roughly 33% increase)

Year Two’s focus will be to supercharge our savings and fund our taxable accounts. We expect that the huge rush of market gains we experienced in Year One will be more of a trickle in Year Two, so we will have to save more this year. We expect to save in the following areas:

Retirement savings: 25%

Company stock: 13.33%

Paying down mortgages: 12.67%

Market gains: 9%

Taxable accounts: 16.67%

College accounts: 10%

Cash savings: 13.33%

Why are we saving so much in our retirement accounts? It decreases our tax liability, for one. Also, because we plan to work while we’re traveling, we’d rather beef up those accounts while we can benefit from lower income taxes. We’re still putting plenty in our taxable accounts and our savings account.

What happens if we don’t hit those numbers? What if the market stays flat? What if the stock “gift” is less than we are estimating? Honestly, if the numbers came in exactly as we estimated, I’d be really surprised. A lot of these numbers are super stretch goals. We’re going to save as much as we can, but I suspect some of those categories may be larger or smaller than I’m guessing here. We’re hopeful they’ll even out in the end. If they don’t, then we’ll adjust course as needed.

Year Two needs to be a mighty savings year to make our plan work. Luckily, we only have a small home improvement project (buying an outdoor shed) slated, and while we have one major vacation planned (more details soon!), we expect it to be very affordable, thanks in part to my brother-in-law’s intrepid planning skills.

I’ll also be making more money than I anticipated for January through June, since I’m working more hours as an ESOL Teacher than I thought I would be. Since I’m a contractor, if we have more English Language Learners who move into our district, then I need to increase my hours to give them the required amount of instruction time. This school year, we’ve had a couple of new students who require lots of instruction time, so my hours have increased quite a bit. I don’t know what the months September through December will look like exactly, because I’m not sure what the final number of students and total instruction time will be.

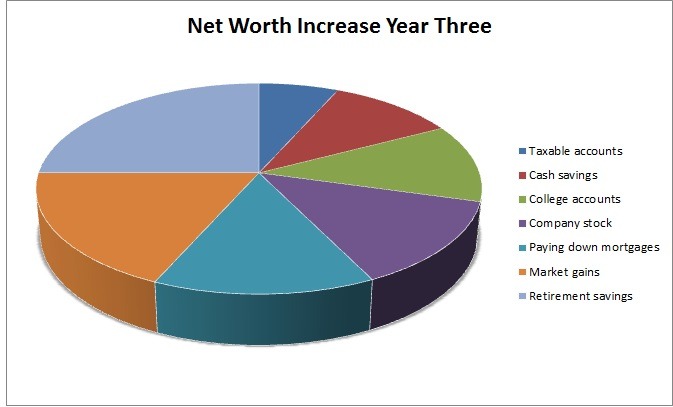

Year Three (roughly 33% increase)

We hope that in Year Three, we’ll reap some of the benefits of our work in Year Two. Since we have so many stretch goals for Year Two, we’re hoping that market gains will help us reach the finish line. Again, total conjecture, as we have no idea what the market will be doing in 2019. But, if it slows down or tanks in 2018, it will hopefully rebound in 2019.

Retirement savings: 25%

Company stock: 13.33%

Paying down mortgages: 14%

Market gains: 18.33%

Taxable accounts: 6.67%

College accounts: 12%

Cash savings: 10.67%

So that is the plan, folks. Because a lot of Year Two’s goals are going to be very hard to reach (saving for retirement + funding so much of our college savings goal + taxable savings + cash savings) I’m not exactly sure if we’ll reach those goals. Our numbers don’t include a lot of wiggle room if something goes wrong (and something always goes wrong!). But, part of the fun of having a BHAG is writing things down that seem impossible. Even if we don’t quite reach that goal, maybe we’ll get close, or maybe we’ll get an extra big stock gift, I’ll make more than expected, etc.

When we were $38,000 in debt, it often felt impossible to image that one day, our debt would be paid off. But we did it. After that, as we started to build our net worth, it felt impossible to reach $100,000 in savings. But we did! And then, it felt impossible to get to $200,000. But we did. And then… well, you get the picture. Fast forward to today, when we’re closing in on bigger numbers than we ever imagined, and it still feels impossible. But I’m confident that we’ll get there, one way or another, sooner or later.

How is your financial savings plan going lately? Is October shaping up to be a good month?

That’s an awesome goal, Laurie! We have not put any specific goals around our Net Worth in the past (other than “increase it!” ), but I like the idea of setting a goal for NW and finding/creating ways to meet it! Good luck with you doubling!!!

), but I like the idea of setting a goal for NW and finding/creating ways to meet it! Good luck with you doubling!!!

For the first couple of years of building our net worth, we didn’t have any goals. But then I noticed a pattern… it took two years to save the first $100K, but then only 18 months to save the next. Then it only took 12 months to save the next $100K. Then it only took 11. Then it only took 10. Etc. So that’s when I started to realize our current investments sped up our net worth growth rate. But just like anything, I think you can get obsessive, so even with this goal, we’re doing our best to meet it but also enjoying our lives in the meantime, and spending $ on our values along the way (like travel). You guys are killing it with your NW by the way to be so young!!

Awesome Goal! My yearly goal is 12.25% (to reach a 3 million dollar net worth in 25 years lol). Good luck, keep pushing those numbers!

Wow! That’s an awesome goal as well. Slow and steady wins the race, after all! Thanks for visiting, Gabe!