Happy December 11th! We still have twenty more days of 2017 left, which will fly by for our family, as we’re preparing to spend most of those days in South America, ringing in Christmas and the New Year with our Chilean family.

I thought it appropriate to go ahead and write an end-of-the-year goals post, though, because we have pretty much completed or are in the process of completing our 2017 goals.

Earlier this year, I shared our 2017 goals for this year, and in July, I shared a mid-year update. This blog documents our three year journey to double our net worth (see our latest update here) and become location independent, so we had some pretty specific goals for this year to make that happen.

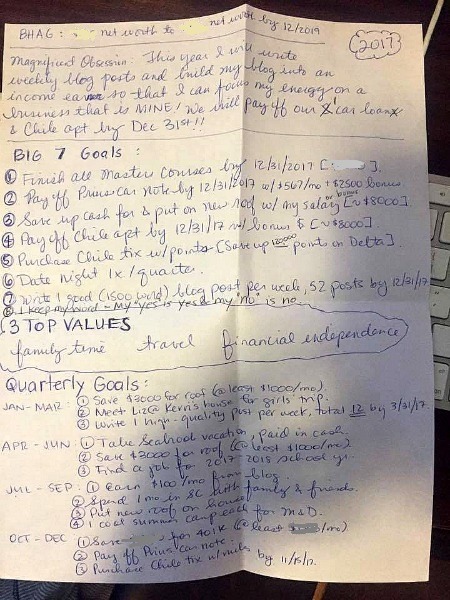

At the beginning of 2017, I sat down with a piece of plain white printer paper and divided our goals up into a couple of sections. I organized our goals from least specific and time-sensitive to most specific and time-sensitive. It may seem like I repeated myself a bit, but this system works for us.

The first section is our BHAG, our Big Hairy Audacious Goal, one that will take more than one year to complete, that will stretch us, and that we’re not completely sure we’re able to achieve. This is the big guiding goal that informs all of our smaller goals, to a greater or lesser extent.

The second section is our yearly focus. This is where I’ve focused most of our efforts this year to achieve our BHAG.

After that, I wrote down our biggest seven goals. These are more specific goals that are SMART (specific, measurable, attainable, realistic, and timely).

Finally, I subdivided each quarter into goals to break our goals down into more manageable pieces.

In the interest of full transparency, I am the goal-oriented one in the family, and although I weigh in with Mr. ThreeYear, I keep track of our progress with these goals.

For 2018, I am going to work at involving Mr. ThreeYear more in the process. Our major goals are the same, but we sometimes disagree about how to get there, so I’m going to work at making 2018 more of a partnership in terms of goal setting. He really dislikes the whole process of goal setting, at least on a personal level. I think it’s very cultural, as we Anglo-Saxons tend to be very goal- and achievement-oriented, and that maybe feels too carnal or Wall-street-tycoon-like to Latinos. I do think that if I approach goal setting in a slightly different way that’s more appealing to him (he’s never been a fan of the family meeting, let me tell ya), then I might have more success in making sure we’re on the same page.

So let’s see how the ThreeYears are faring with our 2017 goals:

BHAG: Double our net worth by 12/2019.

ON TRACK: Here’s our latest net worth update for November. As of 11/30, we’ve increased our net worth by just over 26% from December 31st, 2016. We are roughly aiming to increase our net worth by about one third of the total amount we’ll need each year. I don’t expect to hit that number this year, since because of the laws of compounding, we’ll inevitably make most of our gains in Years Two and Three, but we’re working to get as close as we possibly can to 33.33% by the end of this month.

Yearly Focus: write weekly blog posts of at least 1000 words and pay off all non-mortgage debt.

ON TRACK: So far this year, I’ve written 107! blog posts (including this one), so I’ve surpassed my modest goal to write one per week (I usually publish 2-3 times per week). Most of my posts are 1000 words at a minimum, but as I write more and become more practiced at writing, it has gotten a lot easier to write longer posts. Writing regularly has been such a boon for my self-esteem and mental health. I actually love the process of writing, unlike many people. Having the time and mental space to pin down my thoughts and organize them into some sort of semi-comprehensible order makes my larger life feel more ordered. Even though we all know life isn’t tidy or orderly, my brain feels a bit more tidy and orderly when I’m able to put my thoughts and ideas on paper (or screen, as it were).

So how does this goal help with our larger goal of doubling our net worth and becoming location independent? Just like the adage says, “what you think about, you bring about.” Writing about our BHAG and our three-year plan has not only helped it feel more real and achievable, it’s forced us to think creatively about how to achieve our goals. I suspect that starting the blog inspired me to take another job as an ESOL teacher at a neighboring school district, thereby increasing our earnings and helping us save more and reach our goals faster. The support from readers and commenters has made me feel like our progress is less slow than it feels to me, and encourages me to keep going!

Paying Off Our Debt

As for paying off all of our non-mortgage debt, we’re almost there! I say almost because we have the money available to pay off both loans, but we haven’t quite finished the actual paying off part yet. As of now, we owe $2562.36 on our car loan and roughly $8300 on our Chile apartment mortgage (which is technically mortgage debt, but it’s on a non-principal house, so we’ll call it non-mortgage debt for the sake of this post). We’ll send the money to pay off the car loan via our bank’s bill pay service this week, but we won’t be able to pay off the loan in Chile until we’re actually in Chile. I don’t quite feel anything yet related to paying off those two accounts, because it’s still in process, but I suspect that when both payments actually go through I’ll feel like a million bucks.

Side note: we’ve had an incredibly costly year. We had to put a new roof on our house, we ended up paying for our Chile tickets in cash (more on that below), we’ve pre-payed part of a Disney trip we’re taking next September, and I’ve been paying for my Master’s courses (each course is $1670). We’re hoping next year is back to normal on the major expenses front.

Big Seven Goals:

- Finish all Masters courses by 12/31/2017. FAIL. I didn’t finish all my courses in 2017. I elected to take Spring 2017 and Summer 2017 off, and take only one course this fall (only one was offered). Unfortunately, my university has changed their schedule so that instead of a fall, winter, and spring term, there is only a fall and spring term. That makes it harder for me to take the courses I need, because they’re not offered as often. I still have at least two more classes I need to take, and possibly one more, unless I’m allowed to take it via Learner’s Edge, an online program that is MUCH cheaper than my university ($450 per class instead of $1700 per class). I will be taking my practicum this Spring, and the missing course this summer, and fit the other two courses in somewhere in there. This goal definitely got pushed back because of financial reasons.

- Pay off Prius car note. WIN. We are transferring the total payoff amount to the bank this week. Yay! No more car payments!

- Save up cash for a new roof. WIN. Although we scraped together the $14,000 dollars!!!!!! that it ended up costing to replace our roof and had to dip into our emergency fund to do it, we did technically reach this goal. The new roof looks incredible, and Zillow seems to think our house is worth about $20,000 more with the new roof (or the local real estate market went up; no idea really).

Our new roof is so pretty! And paid for! - Purchase tickets to Chile with points. FAIL/WIN. Although we amassed a large number of points on both American and Delta, it wasn’t enough for the end-of-year ticket requirements to Chile, so we paid for our tickets in cash. We bought the tickets in cash, they are paid for, and we still managed to meet most of our financial goals, so I don’t want to call it a complete fail. But because we are so restricted on when we can go, because of our jobs, we pay a huge premium. That will be one of the benefits of having more flexible job arrangements.

- Date night once per quarter. WIN. We went out at least once per quarter, although we didn’t necessarily go for the sole purpose of having a date. Often, it was related to Mr. ThreeYear’s work, or a friend asking us to come over without the kids, etc. But I’ve realized that we do a pretty good job of hanging out with each other after the kids go to bed, so I don’t think we necessarily need a date night.

- Write one good blog post per week, for a total of 52 posts by the end of the year. WIN. 107 posts written this year, so far. I’ve more than doubled my goal. Yay!

- Keep my word—my “yes” means yes and my “no” means no. ??? This goal is not a “SMART” goal, so there’s no way to really measure it. I’ve been getting better at this, using the phrase “I have to check my calendar before I commit to this” more often than not. But I still volunteer for things I probably shouldn’t. And I often fail to fully consider the time and energy thee commitments add to my plate. For example, a teacher friend asked me if I would be willing to help coordinate a giving campaign at school for Puerto Rico. How can you turn that down, right? I am so glad I said yes, because we were able to identify several families who’ve lost everything, and the generous staff at my school raised $600 for these families! It was incredible. But there was a lot more work involved than I thought, and now I’m scrambling to get the donations in the mail before we leave for Chile (and worried about the logistics of that, given the probable lack of solid infrastructure in their postal system at this point).

Quarterly Goals.

This is where I broke down how we’d achieve the Big Seven Goals each quarter. Here’s how we fared:

JANUARY to MARCH:

- Save $3000 for roof (@ least $1000/month). DONE.

- Meet a friend at my sister’s house for a girls’ trip. DONE. My friend and I met at my sister’s house in Charlotte in September (she flew up from Miami and I flew down from New Hampshire). We had a WONDERFUL weekend and I’m so glad we made this happen, despite a delay of a couple of months.

My friend and I spent the weekend hanging out in Charlotte and surrounding areas. Here we are in Davidson, enjoying the Saturday Farmer’s Market. - Write one blog post per week, for a total of 12 by end-of-quarter. DONE. Goal slayed.

APRIL TO JUNE:

- Take a vacation to South Carolina, paid for in cash. DONE. Some of the details of our Spring Break vacation are here. And we got to spend a week at the beach in July, too. It was so nice.

- Save another $3000 for the roof. DONE. Paid for. Ugh.

- Find a job for the 2017-2018 school year. DONE. I renewed my contractual arrangement with both school districts, and have ended up billing roughly 30-35 hours per week in both schools, a huge increase from last year.

JULY TO SEPTEMBER:

- Earn $100/month from this blog. Not done. I did nothing to pursue this goal, which is a shame. But I’m going to try again in 2018.

- Spend one month in South Carolina with family and friends. DONE. We had a wonderful month in South Carolina, and I feel like this time we get to spend with extended family is one of the biggest benefits to my new job as a teacher. Every member of our household benefits when we spend more time with family.

We spent a relaxed and happy month in the Southeastern US, enjoying views like this. - Put new roof on the house. Done. It’s so purty. It was so expensive.

- One cool summer camp for each son. DONE. The boys loved their week at the camps, which were TimberNook camps. If you’re not familiar with TimberNook, it’s an organization started by occupational therapists who were concerned that kids just weren’t getting enough time outside. The camps are designed to give kids tons of sensory experiences, so they’re located outside, and basically give the kids tons of time and space to build, play, get dirty, splash in water, make forts, climb on ropes, and that sort of thing. I highly recommend these camps, if there’s one in your area.

OCTOBER TO DECEMBER:

- Save $XXX for my 401K (seriously playing catch-up here). Not done. We’ve had so many expenses that I am pushing this goal back to January, February, and March (going to basically save as much as I can before taxes are due April 15th).

- Pay off car. Done. Okay, almost done. It’s going to be good….

- Purchase Chile tickets with miles. Done. They were purchased with money, but they are purchased, and we’re on our way to the (other) land down under, where it will be sunny and warm, because we have opposite seasons.

Why These Goals for 2017?

As a recap, we chose the goals above because we want to pay off any outstanding debt that gets in the way of our ability to double our net worth. We worked hard to kill our monthly payments so that in 2018, we’ll have a lot more cash to invest in a taxable fund. Many of our travel goals were related to seeing family–our week in South Carolina, our month in the South this summer, our three weeks in Chile at the end of the year– and since that’s one of our three top values, we cut our expenses in other areas (like clothing, phones, and cars) to spend more in the areas we love.

I’ll soon write about next year’s goals, and our big focus for helping us increase our net worth and reach our BHAG. I’m still prioritizing the most important things, and hope to have a solid plan ready soon.

What is 2017 looking like for you? Were you able to achieve the majority of your goals? Have you checked them off, or do you still have some outstanding goals to pursue in the next three weeks?

Awesome job on your goals, Laurie! You knocked a few of those out of the park!

Thanks! For me, having good goals definitely helps me achieve more. I feel like some were good, some were meh, but the blog has helped a ton with accountability.

Hmm I don’t think I came into 2017 with goals! Need to change that for 2018!

We’ve been setting side money for a roof too. How long does it take for them to do a roof? Any advice for finding roof contractors?

I’m a goal fanatic (ask my husband!). 🙂 For the roof, it took our guys about a week. They were fast–started at 6:30 and finished up at 9 or so. Mr. ThreeYear said it was incredibly noisy (I was in the South at the time). He worked from home, and said it was hammering all day long. Like anything, I’d recommend word of mouth for roofing contractors–I’d just ask everyone you know who they’d recommend. In our area, it was so hard to get people to write me back or call me back, because we have a shortage of roofing guys–that’s one of the reasons it was so expensive. I had to call ten people for weeks, and eventually got three or four quotes. I ended up picking a young guy who was starting out, who was the fiance of someone I knew. I don’t know how it is in CA, but hopefully there’s more competition. Good luck!! Hope it’s cheaper for you!

Congratulations on sticking to your plan for 2017. It looks like you accomplished an impressive amount! This is an exercise I do every year too, and I’m working on the new list for 2018 right now, though I make a list for each quarter and check in, rather than a full year. That helps me stay on course a bit more and pull myself back in at shorter intervals. It’s such a great feeling to look at an actual list and check off so many things. So often, life feels like slow motion and we don’t realize how much we actually do accomplish. A pat on the back is so much better that beating ourselves up!

I really like that you broke up your yearly goals into quarters. For the most part it looks like you crushed most of your goals this past year so congrats! This inspires me to create a similar quarterly-goal track to follow in 2018. Thanks for sharing 🙂

Hi Zach! Thanks for your kind words and your comment. Yep, I definitely like the quarterly goal tracker, because I tend to be way too optimistic about what we can save, so it’s a good reality check! 🙂 Good luck to you in 2018! I look forward to checking out your goals.