Happy March! We’re (slowly) entering my favorite time of year in the South, Spring. As we drove home yesterday, I noticed that there were tons of blooms on trees and our street (shown in the picture) is blooming.

We’re still getting lots of rain, but there are many sunny days interspersed with the drizzle, at least enough to keep me hopeful that better weather is on the way!

Our Progress

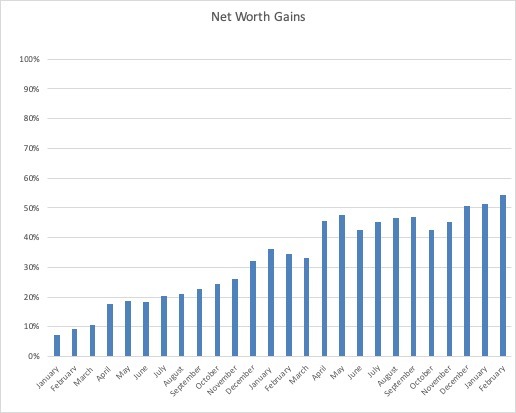

Like many others in the personal finance community, we enjoyed a net worth gain this month. We’re now firmly in the 50%+ camp, meaning that since we started this experiment, we’ve increased our net worth by over 50%. Only 50% more to go this year! I joke, because that’s a lot of net worth to add in a year at our net worth level. Nevertheless, we will keep saving and investing to see how much we can save up in 2019.

Our net worth now stands at 54.2% of where we started. This month, our gains came from the stock market and a small bit more of home equity. We’re continuing to max out Mr. ThreeYear’s 401K, we’re maxing out our new HSA (although we currently only have $460 in the account because we’ve had to adjust our prescriptions–I’ll write a post about our switch-over experience soon), and we’re saving in our college fund.

Spending Update

We are not-a-super-frugal family, so I hope our spending reports are helpful to look at/inspirational if you’re not either.

We’re proof that you can reach your financial goals without being extremely frugal, although that certainly helps things along!

Here’s our financial situation:

- We’re debt free, except for our 15-year mortgage.

- We achieved our dream of location independence, so we’re not in a super hurry to reach FI after doing that.

- We are a high income family, as per this calculator.

- We are not planning to retire for another ten years.

- We plan to retire in the FatFIRE category (here’s the definition of that term).

- We’re not particularly frugal, although we have been working to get better at our spending for the past decade.

Notes on Our Spending Reports

We don’t include our mortgage in the spending reports. These spending reports are a way for us to have a more realistic idea of what we’ll spend in retirement, and since our mortgage will be paid off then, we don’t include it.

We do include the costs we pay for health care, since we’ll definitely be paying those costs in retirement.

Our spending reports don’t show how much we save, only what we spend. But the less we spend, the more we have to save, and that has never been more apparent to us than after getting a month ahead in our budgeting.

We use YNAB to track our spending, and we budget a month ahead, meaning we use money from last month (December) to pay for our expenses in January.

february SPENDING

It was No Spend February at the ThreeYears, except it was really only No Spend February for me. I thought we weren’t going to see a huge decrease in spending, but when I just added up the totals, I realized that we did spend less than normal. It really worked! I learned a lot from the experiment and I will do it again.

Charity

Charity: $78. Compassion International plus contributions to the local church we’ve been attending. We have not yet pledged a tithe to the church and this low level of giving has been eating at me.

Food

Groceries: $795.57 We spent more than I’d hoped in groceries, but aside from the mega-birthday lunch, we didn’t eat out at all this month, so this amount constitutes pretty much all the food we consumed for the entire month.

Eating Out: $315.34. We took five members of my family out for a special birthday lunch at our favorite restaurant in Davidson, Kindred. We went all out, too–appetizers, drinks, dessert. It was such a great meal!

Fun

Entertainment: $27.43. We purchased the movie Bohemian Rhapsody while my parents were visiting in early February so we could all watch it. Mr. ThreeYear and I had seen it in theaters and it was so good.

Fun Money: $114.98. Mr. ThreeYear paid for a Spring tennis group (only $25) and am upgrade in American Airlines from Brazil, to get him an Economy Plus seat. His company won’t pay for these upgrades but we decided it was worth it, since he’s 6’2″ and Economy seats are pretty miserable on long, ten hour flights. I had $1.99 charged twice to me for our Google storage accounts.

Gifts: $47.25. We sent a birthday gift to a dear family friend and Mr. ThreeYear bought himself a splicer for his birthday gift, an XBox. That way we could use it with our downstairs TV.

Health

Health Insurance: $447.68 This year, we switched to a high-deductible HSA account. In addition to our health and dental premiums, we also have $250 per paycheck taken out for our HSA fund.

Fitness: $329.29. This includes our swim/tennis dues and several clinics (group lessons) for Mr. ThreeYear and me. Since we’ve moved to North Carolina, we’ve decided to prioritize fitness.

Household

Clothing: $102.76. Right before I started the No Spend February challenge I bought myself some new leggings and a sports bra from Fabletics for $41.81. Mr. ThreeYear bought underwear, socks, and two shirts for his trip to Brazil at Ross.

Haircare: $0. Goose egg.

Home Maintenance: $268.19. This includes a sound bar for the TV upstairs, which we now use with the sectional sofa we bought for $250 (which only looks like it cost $182.50 in YNAB because we used some cash we’d earned from selling another piece of furniture), plus $25.69 for a set of towels I bought before the No Spend February hit (yes, I bought a lot of stuff in the first four days of February). I got four big towels and a hand towel from Macy’s for $25.69 (Martha Stewart brand) and I thought that was a pretty great deal!

Household Goods: $209.15. A lot of this was for a big shipment from Amazon including detergent, dishwashing detergent, coffee filters, and other household supplies.

Kids

Babysitter: $59.45. Once again used Bambino for our special birthday lunch at the beginning of the month. Our sitter cancelled on us and we found another one within two hours.

Lessons & Activities: $380.33: Two 30-minute and two hour-long tennis lessons for Little ThreeYear, two field trip fees for the boys, one climbing session, and payment for Little ThreeYear’s Lego Afterschool Club for Spring

Allowance: $25.13 Junior Three Year bought three books at the Book Fair.

Pet

Pet: $74.26: A bag of dog food, a new leash (which she’s already chewed through!), and some chewing sticks

Transportation

Gas: $68.53

Utilities

Internet: $54.95.

Subscriptions: $37.94. Ooma, Spotify, Skype, Netflix.

Amazon Prime: $119.95. Once-a-year payment.

YNAB Subscription: $50. Once-a-year payment.

Electric: $85.05.

Natural Gas: $172.90. Hoping this goes down from here on out.

Water & Sewer: $39.99.

Cell Phone: $36.76. Through Total Wireless.

Total: $ 3940.88

Here it is in a condensed format:

February 2019 Spending

| CATEGORY | COST | NOTES |

|---|---|---|

| Charity | $78 | Compassion International, offering at church |

| Food | $1110.91 | groceries, fancy birthday lunch |

| Fun | $189.66 | one movie purchase, tennis league, flight upgrade, birthday gifts |

| Health | $776.97 | health insurance and fitness costs |

| Household | $580.10 | maintenance costs, household goods, clothing, and new sofa |

| Kids | $464.91 | tennis, climbing, babysitter, Lego Club |

| Pet | $74.26 | dog food, new leash, chew sticks |

| Transportation | $68.53 | gas |

| Utilities | $597.54 | internet, phone, Spotify, Skype, electricity, natural gas, water & sewer, Amazon Prime |

| TOTAL: | $3940.88 | Wow! Our lowest total in a while. The No Spend February really worked! |

I didn’t think we’d really saved that much, but in adding it all up I see that we had one of our lowest totals ever. The No Spend February really did help us spend less overall. I need to bring that awareness into March and the rest of the year, for sure.

The Trouble With Moving

One of the things I was talking about with my sister, who also recently moved into a new house, is that when you move into a more expensive house, you have to adjust to the new mortgage. Our new mortgage payment is $600 higher than our old mortgage, and on top of that I’m not working. That’s given me the feeling of having less money since we’ve moved.

I know that research shows that one of the best things you can do is to stay put, that is, not move houses again and again, in order to build wealth. Given our own experiences with moving, I know this is true.

While we’re so glad we moved for a host of reasons, we’re still getting used to our tighter budget. So I recommend that if at all possible, embrace where you live and stay put!

Happy March!

Um, maybe I missed something here — why isn’t your mortgage payment included in the monthly spend?

Good question Mr. Tako. We include our taxes, home maintenance, and insurance because we’ll have those expenses in retirement but we’re planning to pay off our mortgage before we retire. Since I want to get an idea of what our spending will look like in retirement I’m excluding it. Add $2400 in to our total expenses for our 15 year mortgage and you’ll have our total spending with mortgage.

Got it, thanks!