I realized, recently, after I saw the Pinterest quote above (credit: CleverGirlFinance), that I no longer notice when payday is.

Sure, I eventually notice when paychecks land in our bank account (which I keep track of through our budgeting software YNAB), and I put them into our “To Be Budgeted” envelope to save for the following month, but I don’t remember if it’s this Thursday or next Thursday that paychecks will hit.

I will often let a few days or even a week go by before I do anything with that money, because I forget it’s there.

I don’t worry about when our paychecks will hit because we no longer need this week’s paycheck to pay our bills.

Believe me, I worried about when we got paid plenty before this past year. Even though we were debt free and on our way to FI, I still had to make sure we had enough cash in our accounts to pay the bills.

It’s only after getting a month ahead in our budgeting that I no longer worry or think about when we get paid, because we use last month’s income to pay this month’s bills.

And it’s as awesome as it sounds.

We should have made it a financial priority years ago to get a month ahead in our budgeting. It means we have so much less worry and anxiety around paying the bills. I never have to madly check my bank balance right before the 18th of the month (when our credit card bill is automatically paid) because I know we’ll have the money available to pay the bill.

Read exactly how we got one month ahead in our budgeting here.

Yes, I still sweat purchases. I worry when we spend too much, or when we overspend, because I have to take money from our savings to make our budget balance. And that still happens, because we’re spendy by nature.

But, I don’t ever touch next month’s money, because that is sacrosanct. It’s there to pay next month’s bills. I may have to wait until next month to get something I really want, but that’s okay. I’ve learned to pace myself and wait a month or two.

The feeling of not having to worry about how much is in our bank accounts is hard to describe.

It’s made me feel carefree, a little bit. Just one less thing to worry about.

What Changed?

The truth is, we haven’t really gotten better at budgeting in the last year. We still go over budget plenty.

We haven’t magically spent way less. In fact, we’ve been spending a lot more since becoming location independent and moving to North Carolina.

The only thing we’ve done differently, that’s allowed us to not worry about our bank balance, is to get a month ahead in our budgeting.

Yes, this post assumes you have a budget. If you don’t, you can still follow the suggestions, and keep this month’s money in your checking account, while getting next month’s money deposited somewhere else (like an attached savings account). That way, you can keep the money separate, and just transfer it over on the first of the month.

So how in the world do you get a month ahead in your budget?

I have a couple of suggestions.

Moving House

The way we got a month ahead in our budget was when we sold one house and bought another.

First, we took some of our home equity (we had a lot since we’d paid down six years on a 15-year mortgage) and put it aside for moving expenses, home repairs, and general new home costs (I’m so glad we set it aside instead of putting a larger down payment on the new house).

We took the rest, and put a 25% down payment on our new house.

Then, because we didn’t have a mortgage payment for the month of July (because you pay your mortgage at the end of the month rather than the beginning), we saved that money in our “to be budgeted” fund for August.

We put some of our home equity savings into our “to be budgeted” fund as well, and gave ourselves a smaller-than-normal budget for August.

At the beginning of August, we put all the money we’d tucked away in the “to be budgeted” category into the requisite envelopes.

We spent very little that month, only what we had budgeted.

Then, we put both of August’s paychecks in our “to be budgeted” fund and let them sit for the month of August.

At the beginning of September, we had an entire month’s worth of money waiting for us to budget with.

Since then, we’ve continued to budget the money we have in our “to be budgeted” fund, and save money from the current month for next month.

Now, I know that this method assumes you have enough equity in your home to put down a reasonable down payment, pay moving costs, and have something left over. If that’s not your situation, keep reading.

Using a Windfall

Many people use a one-time windfall, like a tax return, a large cash gift, or a small inheritance to get one month ahead in their budgets.

If you know you normally receive a certain amount back in taxes each year, consider putting it towards your goal.

You could even use several small windfalls saved over time.

Consider selling vehicles or goods you no longer need and using that money towards your goal. Some ideas:

- lawn equipment like riding lawnmowers or pressure washers

- JetSkis

- boats

- musical instruments

- amplifiers or microphones

- game consoles

- PCs or laptops

You might even consider downsizing your car, if it’s paid off, and using the money to fund your get-ahead month.

Creating a Sinking Fund

If you don’t have access to a large chunk of money, then I suggest budgeting as much as you can each month to create a “Budget a Month Ahead” sinking fund. If you’re able to set aside $200, $300, or even more each month for a sinking fund, then in a year or two, you’ll have enough set aside to live on for the month without having to touch that month’s paychecks.

You generally won’t have to budget quite as much as you would for a normal budgeting month for your first month of budgeting ahead, because remember, you can forgo saving for that first month just to get started on budgeting a month ahead (it will be worth it, trust me).

Your Get-Ahead (First) Month

For your first month, where you’re saving up your monthly paychecks for the first time, keep a bare-bones budget, and remember that you just have to do it for one month so that you can get ahead in your budgeting and not live paycheck to paycheck anymore!

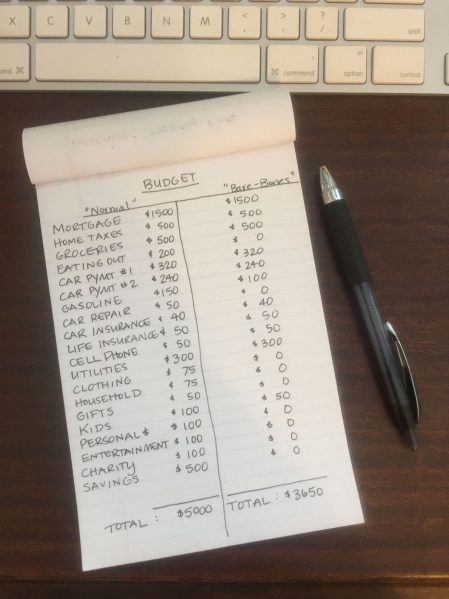

For example, let’s look at an example normal budget versus a bare-bones get-ahead budget:

This is a sample budget, so your own numbers may be higher or lower. However, the idea is for you to get an idea of what you’d cut out during your first month, so you could see what you actually need to save up for your get-ahead budget month. Cut out any non-essential expenses like eating out, entertainment, and even savings, just for one month! Then, you’ll have a full budget to work with the following month, so you can go back to budgeting normally.

Sinking Funds

Once you do begin budgeting with last month’s money, you’ll need to create “sinking funds,” the funds that you save up to pay large quarterly, biannual, or annual expenses. We have funds for our home and auto insurance, car maintenance, and home taxes, amongst others. By saving $30-$100 each month, we can ensure we’ll have enough budgeted in each category when the time comes to pay that bill. Then we don’t have a huge bill coming in that destroys our budget for a particular month.

In July, for example, both my auto and home insurance bi-annual payments are due. Luckily, I’ve been saving money in my sinking funds all year so the over $1000 combined bill won’t kill my July budget.

We also have sinking funds for more expensive things we’re saving up to buy, like patio furniture or a trip. Then, when we’re ready to buy the item, we’ve got the money ready and waiting to pay the bill.

Savings

I’ll be honest–sometimes we do go over budget. That’s where our savings fund helps. We set aside a certain amount of money from Mr. ThreeYear’s end-of-the-year bonus as a sort of slush fund that we can tap into as needed. Then, we repay the slush fund money the next month, if at all possible.

Ideally, we wouldn’t ever go over budget, but we do. So, this has been a way to help us never use next month’s money for this month’s expenses.

I would never have thought that getting a month ahead in our budget would reap so many positive financial benefits, but it definitely has. One of the best parts of it for me has been seeing that our supply of money is finite. It helps me realize that once this money is gone, that’s it and I cannot spend any more until the following month. It’s helped me get (a tiny bit) better at saying “no” to things because I can say to myself, “we don’t have the money budgeted for this so it’s not a priority.”

Do you budget? Do you forget it’s payday, or are you very aware of when you get paid? I’d love to hear from you in the comments!

It is an interesting concept. I am glad it works for you. My husband and I force as much money as possible to the saving account automatically. I am the spendy one of the two of us; I manage my behavioral tendency this way as I deliberately don’t look at savings balance. We do keep a one pay cushion in the checking, but bills are paid based on paycheck because it is good reminder of time to handle them. My husband being the saver, wants the credit cards paid twice a month; often before the amount is even billed. This is especially true of vacation. If everything is paid ahead he can relax and enjoy. This means the CC is overpaid for charges we know will bill such as hotel.

This works to make things easier for us.

That’s a cool way to handle it. I don’t ever pay off the credit card early, but when the balance is getting high, sometimes it worries me a little so I may try that!

Another YNAB budgeter here, also a month ahead. I still remember when pay day comes, since it only comes once a month, and it’s different now. I look forward to my pay days because it’s more money to put toward my savings goals. I love watching the balance, or the amount I keep, growing, and is possibly the highlight of my month. YNAB helped make me aware of my choices, and what my priorities are. I love it. And even more, I like watching my net worth increasing.

Woot woot! Congrats, TJ! That is amazing. Love YNAB.

I am working towards getting a month ahead in my budget. I imagine it would feel so freeing and so less stressful.

This is off topic, but I love your curtains!

Thanks so much! I actually got them at Walmart! 🙂

Great tips on becoming more financially secure and independent. I agree and think that budgeting is super important; whether it’s an app or a spreadsheet. It’s also important to give yourself a break (as you did) when you go over budget and don’t hit your savings/investing goals.

Interesting quote at the beginning of the article – despite feeling quite financially secure, I do still know and get excited about payday!

Ha! Well, okay, it’s still fun to look at our bank account and see that it’s grown from payday. 🙂