Like so many of my posts, this is one I’m writing for myself. Because my spending is…

Luckily, our investments are doing well (as are pretty much everyone’s at this point). Mr. ThreeYear and I have been investing most of our adult lives, and are finally at the point where our net worth increases more each year than we make.

We’ve never been particularly frugal (I haven’t, especially), so we are cruising through life at this point, eating out, buying food (food is always our Achilles Heel), planning vacations, and generally not being especially careful with our money.

Luckily, our old standby tricks of saving are helping, somewhat, but as I look at our cash reserves throughout the year, they are decreasing, precipitously, as the months roll on.

New Job

Part of the reason we are spending so much is that I got a new job, and we no longer have to pay private school tuition. I didn’t fully realize how tight our disposable income was until I contemplated a much bigger take-home pay check, and realized the pressure in my chest released a LOT.

Over the past year and a half, our take-home pay dropped quite a bit. First, we took out a ten-year mortgage, which increased our mortgage payment by $450. Then, we put one child in private school, decreasing my take-home pay by $250 per month. Next, we put the other child in private school, decreasing my take-home pay by another $250 per month (the reason it didn’t decrease more than that was because I was maxing out my 403b beforehand, and so converted saving for retirement into handing over that money to the school–but it also increased my taxable income, meaning I had to pay more in taxes each month).

Then, I got a tax bill this April that showed I wasn’t contributing enough in taxes, so I had to increase my taxable contributions by another $300 per month. I am a teacher, I would like to remind you, so I don’t have a huge paycheck to begin with.

After all of those decreases in take home pay, we have slowly been draining our savings (because we haven’t decreased our spending in line with our decrease in take-home pay). That also happened because we had to buy a new AC unit and we took a fancy trip to Napa.

I made the decision not to fully max out my 403b right now, because we need a little more take-home pay this year (I am contributing $10k). I want to build our savings back up, have money for trips, and otherwise enjoy the heck out of this post-Covid year. Still, I will have loads more take-home pay than I did before.

So that’s part of the reason we’re spending more, because I know I will be earning more this year (a year for me is a school year, as my contracts go from August to July).

Summer

The second reason our spending is up is because of summer. We are dining out, meeting up with friends, taking the kids to D.C., buying season passes for the local theme park, and buying tons of food.

I am not being as careful as I was last summer with our spending.

Money Money Money

Part of our carelessness with our spending is related to the fact that our investments are doing well, and are growing independent of our amount of contributions.

I know this will not always necessarily be the case, but I am finding it hard to stay motivated to keep spending low when we’re doing so well financially.

Hence this post. How do we stay motivated to be careful with our resources and not squander them, which I feel we are doing a bit this summer?

Which brings me to one of the ways I know we can improve our spending.

First off, when school is back in session we will naturally spend less in August. We always do. We are so focused on getting into a routine for school that we naturally hang at home a bit more.

But I am working to proactively get systems in place to help us with our spending.

Here is what I am thinking.

Plan Ahead

One is to plan ahead. Mr. ThreeYear and I have talked about how we would like to put some systems in place to help us function more efficiently as a household.

How will this help us save money? I’m hopeful that planning ahead will allow us to create routines which will help us save money.

For example, we plan to order groceries each week. We have decided to order groceries on Fridays so that we can have yummy things to eat each weekend (and will therefore hopefully be less likely to eat out on weekends), and then will use Sundays to meal prep.

We are going to set aside one night per week to eat out, which is the “Kids Eat Free” night at our neighborhood restaurant, so that will also be a weekly social touchpoint for the kids and for the adults.

We are planning ahead, way ahead, for our vacations this year. I already have our hotel booked for Spring Break (it helps that I don’t have to pay anything and can cancel it up until the day before we go). How will that help save money? By booking early, we’re likely to get a better price. I found this when booking hotels for our Washington, D.C. trip. People are also so ready to travel that hotels are selling out fast and that’s causing prices to increase. We saw this when we tried to book a trip for Hawaii this summer, and saw that hotel prices shot through the roof faster than we could say, “maybe later!”

Planning ahead for vacations also helps us determine our priorities. I’m really guilty of not planning ahead for vacations, then getting to summer, lamenting, “What are we going to do?” It’s a case of not making vacations a priority and therefore not saving the money beforehand.

Planned vacations also give us something to look forward to. We have two days in October where we’re off on a Monday and Tuesday, so we are planning a mini-break (love that term!) to the beach. Knowing it in advance will help us get excited, plan for groceries, and budget for extra gas that month.

Budget Our True Expenses

One of the things that happened last year was there just wasn’t enough monthly income (after our saving and investing was taken out) to fund all of our true expenses each month. What are “true expenses”? That’s YNAB speak for the yearly expenses that you need to plan for each month in order to have a true sense of your monthly outlays. I budget each month for my home insurance, Christmas spending, auto maintenance, and a host of other periodic spending that must be accounted for.

Last year, I wasn’t able to budget what I knew I needed to save each month in order to pay those expenses. And so, I would end up robbing from our savings when we inevitably spent more than we had budgeted for those expenses–travel, home repair, new tires.

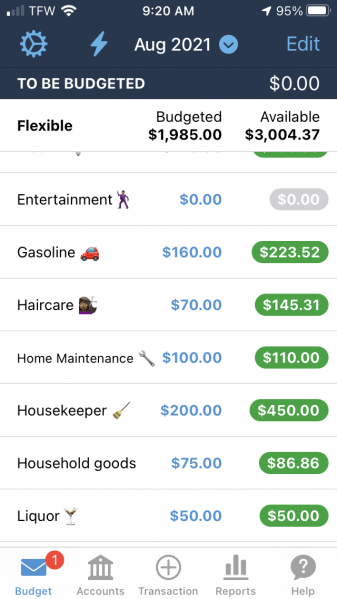

For next month, I have a budget set up that should generously allow even for overages in eating out, groceries, and pet care. That way, I hope to be able to build up more of a surplus in some of my budgeting categories so I am ready for those “unexpected” but still fairly predictable expenses. Take a look:

Pay Attention

When we pay more attention to our budget, we spend less money. When I act like budgeting categories are real barriers around my spending, I do better. Ironically, because we had less disposable income to fund our budgeting categories last year, and I knew we would be going over in many categories, I ignored the categories altogether and spent freely. Now that I know we have enough money funded in each of the categories and I should be able to easily stay within those parameters, I’m hoping to be more likely to pay attention to my spending and watch carefully as my money declines in each budget category.

It feels like no matter how old I get, I still have the same lessons to learn–pay attention, be careful, think before you buy. I’ll be sure to keep you posted on how it’s going.

One thought on “How to Stay Motivated to Save When Your Investments are Booming”