Our family’s dream is to move internationally in three years. In order to do that, we’ve set a goal of doubling our net worth by December 2019. While that amount of money won’t replace our yearly expenses using the 4% rule (yet!—we’re slowly bringing down our spending), it will give us enough financial security to leave our “safe” jobs to travel.

For us “semi-adventurous” folk, having that nest egg in the bank is important. Everyone has different levels of tolerance for financial security.

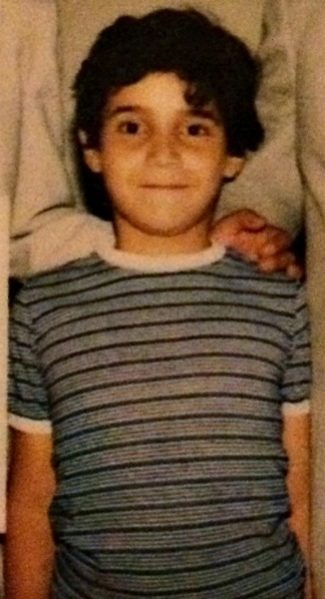

My husband grew up very, very poor, in Santiago, Chile. While his family always had enough food to eat, he spent time after school collecting wood scraps in order to heat their house. His mom worked three jobs after his dad died, when he was 13, in order to keep their family afloat. As you can probably imagine, financial security is important to him.

I grew up in a household with plenty of money.

My father was a pediatrician, and we not only had enough money to take care of every material need, we got to go on amazing trips—skiing out west, wine tasting in Napa (well, water-tasting for me as I was 10), weeks at the beach, etc. As I grew up, if I had a financial emergency, I knew my parents would help me. If they couldn’t help, I knew my grandparents would help me. We were in an incredibly privileged situation.

The after-effects of those two different childhoods are two very different adults: my husband, who isn’t much of an investor but is naturally frugal, and me, obsessed with building our net worth but a reformed spendthrift.

As we raise our two boys, our goal is to teach them the values we’ve collectively embraced as a couple—thrift, that is, being careful with the resources given to you, adventure, the spirit and ability to travel and see the world, and entrepreneurship, the idea that they can realize their dreams through hard work, perseverance, and creativity.

Our boys are currently 9 and 6, and when the Three Year Experiment is over, they’ll be 12 and 9. While I hope that they will have embraced thrift and entrepreneurship during our years in New England, the spirit of adventure is something we could work on.

Net Worth Update

Our biggest goal, bar none, is to double our net worth by the time I’m 40. If our starting place is exactly half of what we want (we’ll call that 0%) as of January, we are currently 7.2% toward our goal. Only 92.8% more! If we have thirty-six months to reach our goal, we’ll need to make 2.77% of progress each month, so we are actually doing ok at this point.

Since December, our net worth has increased by 5.2%. Most of that increase has come from re-valuing our Chile apartment to reflect its updated market worth.

I know all you financial voyeurs out there want actual numbers, but for now, you get percentages. Everyone’s financial situations and goals are different. For us, the goal is to make steady progress (or heck, killer progress!) in increasing our net worth, and to reach our goal, we’ll have to get better at the small stuff–our daily habits. We’ll have to continue to decrease our yearly spending, putting those dollar savings into my 401k and our taxable accounts, and increase our earnings. My husband is our main income earner, working full time, while I work part-time at the kids’ school as an ESOL teacher (aren’t acronyms fun? That would be the teacher who helps English learners), kid wrangle, and write this blog. We have learned, over the three years that I’ve been working part time, that me working more doesn’t necessarily translate into more savings for us, as it costs our family in the daycare/camp, transportation, and food departments. We’ve also realized that our family’s overall sanity level is affected, because when mama’s stressed, “ain’t nobody happy!”

Next month, I’ll post some spending updates, to keep us honest. I’m focusing this month in keeping grocery spending low. This is my Achilles heel.

Thanks for following our financial journey towards location independence! Whoo hoo!