It’s raining right now, which is a small hint that Spring is making its way, slowly, to New England. The start of April signifies that we’ve entered the fourth month of the year and our experiment continues.

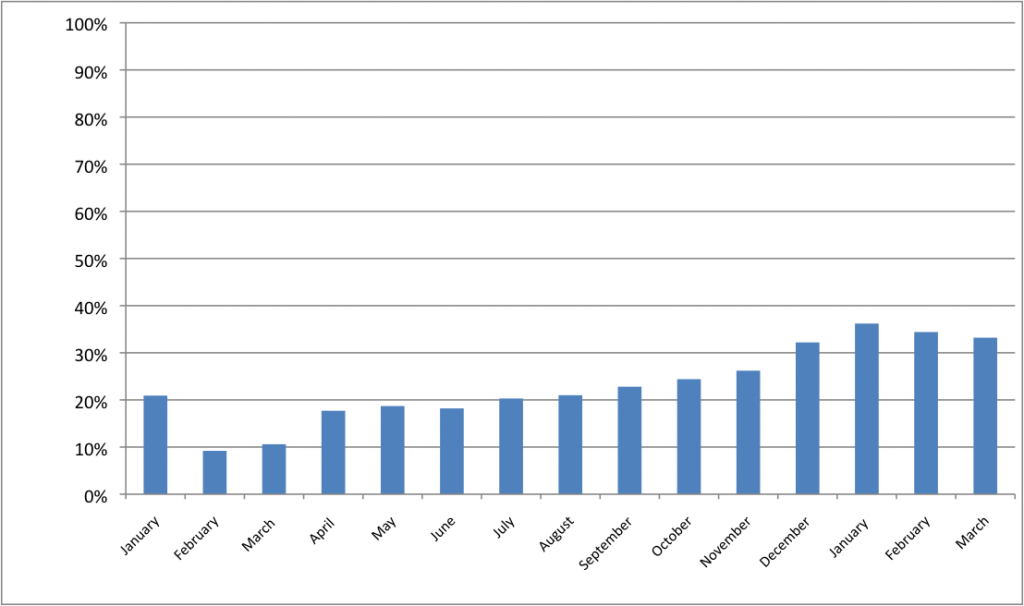

If you’re just joining, our family of four is on a three-year journey to double our net worth and become location independent. Each month, I record our progress on our net worth and our spending (gulp!). Last year, we increased our net worth by 32% over the year before! This year, we’re trying to increase it by more than 65% from where we started in December 2016. Given the wild ride the market’s likely to take us on this year, I’m not sure it’s doable. But we’re going to try.

March is always my least-favorite month of the year. The rest of the country is enjoying the first signs of Spring, and we’re still covered under snow. This year, March lived up to the adage, and came in like a lion, with storm after storm that buffeted us with snow and left the skies gray and damp. It went out like a lamb, with a few days at the tail end full of blue skies and (slightly warmer) temps. But April has brought wind storms, more cold weather, and a reminder that here in New England, there is no such thing as Spring.

Our Progress

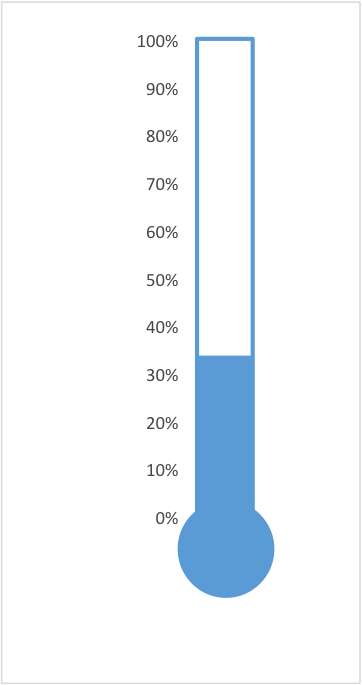

As of March 31st, our net worth has increased by a total of 33.2% from our starting point in December of 2016. This is not very exciting to report, as our net worth has decreased from last month, and from January. Still, we’re continuing to put more money into the stock market when it’s lower, and we actually managed to save quite a bit this month, so I’m confident that I’ll have another increase to report soon.

Here’s a graph to track our progress:

This is as a percentage of our total goal:

Spending Update

We know that we spend more than the average frugal financial blogger. But there’s nothing quite like publishing these figures to keep us honest. And I know publishing our spending will eventually change our spending habits. Slowly, but surely. Plus, we want to share with others that even if you have higher spending levels than other people, you can still achieve your financial dreams and goals.

MARCH SPENDING:

Housing: $1775. One fifteen-year mortgage payment. Taxes and insurance are not escrowed–we pay those twice a year.

Gas: $218.14. Slightly high, but we had several day trips we took with the kids.

Auto maintenance: $10. We heard a scraping sound on the Prius, and our mechanic was able to screw the fuel plate (?) back on.

Auto insurance: $313.50. Twice a year premium.

Home insurance: $398. We pay this twice a year.

Groceries: $757.24. This was the third month of our Year of Good Food challenge, where we’re trying to keep grocery spending 20% lower than last year, or less than $772 per month. (March had five weeks and was really tough).

Eating Out: $217.35. We ate out more than I wanted to this month, because of a couple of school events away from home and several disrupted evenings where I needed to keep the kids out of the house while Mr. ThreeYear worked. This was a big fail in terms of my Lenten challenge to only buy groceries and gas. Full report to come.

Household goods: $243.26. Printer ink, toiletries, etc. I have to take one pricey printer ink back because I bought the wrong kind. Argh.

Library fine: $11.70. I rock.

Babysitter: $45. We went to a dance party at our friends’ (no kids) and it was so. much. fun. PS: Mr. ThreeYear can dance.

Kids’ expenses: $300.40. Two months of piano lesson checks were cashed, one pre-pay for Spring track, and snacks for DI.

Mr. ThreeYear’s spending: $141.61. Work lunches, mainly.

Mrs. ThreeYear’s spending: $42.29. Two books that I’d pre-ordered.

Propane: $457.84. During the height of winter, we pay a lot in propane costs.

Other utilities: $299.97. electricity, internet.

Clothing: $0. Goose egg.

Haircare: $25.

Fitness: $173.64. Mr. ThreeYear has started to do CrossFit at his pricey gym. (Preventative medicine, preventative medicine!). He did get a second check back for $111.50 as an incentive for going to the gym over 12 times, so that made it effectively cheaper.

Housekeeper: $120.

Subscriptions: $29. Netflix, Spotify, Skype.

Gifts: $23.98. One birthday party gift.

Total: $5602.92

Total without mortgage: $3827.92

If you’re wondering how we were able to pay off $38,000 in debt and build a high net worth in less than ten years, read more about it, despite lots of mistakes and a late start, here and here. We’ve also worked to increase our incomes which is a big factor as well. Read how we did that here.

(Part of our success comes from keeping spending low on our housing and cars, and this year trying to keep it lower in the third big $ category, food).

First Quarter is in the Bag

That is it for the first three months of the year. We’ve entered April and with it, rain and more snow (April truly is the cruelest month in New Hampshire). I can start to see the finish line–winter is ending! The mountains have closed, I can see some (very brown) grass, and once in a while, the sun even deigns to peak his head out.

Happy Spring to each of you! I hope April is a good month, financially and lifewise!

I’m so looking forward to spring. Here in CT it looks a lot like NH-I’d like to be able to clean out my garden without digging around a ton of snow. Hopefully this weekend!

I hope we get warmer temps this weekend! Fingers crossed for you, my super-efficient friend! 🙂

You aren’t there yet, but you are getting closer 🙂 – love it!

Thanks Chris. I’m ready to have some more positive progress in 2018! I feel like April is going to be a good month.

My hubby can dance too…well, not in the traditional sense, more in the form of shimying, but we have so much fun at weddings dancing! And I pay library fines too, whoops, but there are worse ways to spend your money. Awesome summary!

Haha that paints such a great mental picture. Dancing (or shimmying!) at weddings is so much fun. Glad I’m not the only one who pays fines. The librarians always speak to me in a hushed voice, “You have a very. large. fine. It is $10.” And I think, “cheaper than buying a new book. And I’m supporting our wonderful library!” So I forgive myself my slightly disorganized library book returning habits! 🙂

I’m with you Laurie on wanting Spring – and you know what – there are signs of it arriving here in London today.

And you are very lucky that Mr ThreeYear is a good dancer!

Ooh I hope it arrives soon in full! Yes, I consider myself incredibly lucky! 🙂

“A view of our small New England town from the library. This is what Spring looks like.”

Woah that photo is cool. That is exactly what I pictured a New England town would look like. My husband CANNOT dance. He looks like a one footed chicken wagging his butt around. It’s really bad…really bad…really cute.

Hahaha there are a lot of white American boys with that problem. We’re not really a dancing culture. Mr. ThreeYear definitely makes me look better on the dance floor. Yes, it is amazing, but around here, everything looks iconically New England. Down to the old abandoned barns. And snow. So much snow. All the time. Into April. 🙂

Cool picture of your town. I had to chuckle a bit…taking a picture of the Church after leaving the library paying a fine. 😉 I think many of us have rocked that way at least once. Nice Easter picture!

Haha Amy you caught that! 🙂

Progress is progress! Some months are slower than others because of life circumstances. The important thing is that you’re moving forward and have a solid plan in place. I think you guys are doing great – keep it up!

Thanks Kara! Yep, I agree–sometimes you can’t see or feel the progress but it’s there all the same, in changed habits, saving more, investing more.