In July of 2018, just after my family moved to North Carolina, we finally made it a priority to get a month ahead in our budget.

We took money we saved from not having a mortgage payment on the first month we bought our new house, together with some savings, and used that to create a bare-bones budget for the month of August. We lived on that money during the month of August and saved Mr. ThreeYear’s two paychecks to use for the next month, September.

We’ve kept this system up ever since, so that the money we budget is the money we earned from the previous month.

This has been a phenomenal system for a couple of reasons. One, we have a cushion in our bank account so we never have to worry about the timing of our credit card payment or other bills being taken out. Two, we know exactly how much we have to spend each month, before the month starts, so there’s no guessing with budgeting.

So why am I saying that we got a month ahead in our budgeting again?

I started a full time job last August, and began to get two paychecks per month. I am currently maxing out my 403b, and I’m a teacher, so to say that the paychecks aren’t huge would be an understatement. Still, they’re nice additions to our bottom line.

When I started to get regular paychecks, I decided not to add them to our budget, because I wanted to save them, or spend them on non-budget stuff.

Did I think that by not budgeting the money in our traditional money things we would somehow be more efficient or productive with the money? Apparently I did.

The months passed, and those paychecks got eaten up in some way or another, very rarely being spent on purpose like I had envisioned.

When we refinanced our mortgage to a 10-year, and our monthly payment went up by $450 per month, I realized that something needed to change.

I needed to add my paychecks to our budget, because we needed them to pay the bills. As much as I didn’t want that to be true, it was. We were going over budget every single month and if we wanted to make headway on savings goals, we were going to have to have a clear-eyed vision of exactly where our money was going.

At the same time, I finally admitted to myself that I wasn’t very good at budgeting.

Guys, I have been budgeting since 2008. That’s twelve years. That’s a long time to be bad at something.

But you know that saying, if you keep doing what you’ve been doing, you’ll keep getting what you’ve been getting?

I have continued to make the same mistakes in budgeting since I did at the beginning of our debt-free journey, and I decided that I was going to get better at this.

Before I tell you what I’ve been working on and how we got a month ahead (again), let me just share that since we switched to YNAB budgeting software in 2017, I have improved at budgeting.

I largely stopped the trend of overspending one month and “paying myself back” during the next month, which never worked.

Part of the problem, which I realized when I formally added my pay to our budget, was that we just didn’t have quite enough money with Mr. ThreeYear’s paycheck to cover all our bills AND pad our budget for our periodic expenses.

This is because when we moved from New Hampshire, our mortgage payment was $1800. Then, when we moved to North Carolina, it went up to $2400 per month, while our income went down, because of North Carolina taxes being taken out (we didn’t have any state income taxes in NH). We also added the considerable expense of our country club swimming and tennis membership to our budget, something we’ve gotten a lot of physical and social value from, but something that has strained our budget even more.

Finally, last month our mortgage payment went up to $2850, because we refinanced it to a 10-year payoff period. That’s a lot of mortgage payment, and it does not include taxes or insurance. Some of you may think we didn’t make the right decision to pay off our mortgage so quickly when interest rates are so low, but after many discussions, Mr. ThreeYear and I decided that for our particular goals and plans, it did.

So now you know why our budget felt tight. It was. I didn’t completely realize this myself, until I made the decision in March to save my paychecks (but actually, really save them this time) and add them to April’s budget.

One of the silver linings of Covid-19 was that we had less expenses in March because we spent most of the month on lockdown. So that made it a bit easier to stay in budget. I also obsessively (every single day) checked YNAB to make sure we were staying in budget, and I moved money around like a champ to make sure expenses were covered before I made them.

For example, when we went on lockdown in mid-March, we started ordering takeout every Friday night. To make sure that these expenses were covered, I moved money from haircare and gasoline categories before we ordered, to make sure we had enough to spend. That also dictated what kind of takeout we got. Expensive sushi? Not this time. Instead, pizza was good.

When the last few days of March rolled around, and we now had four paychecks in our “To Be Budgeted” account, I called Mr. ThreeYear over and got him to help me budget.

Mr. ThreeYear does not like to be part of the budget process. He finds it boring and stressful, an ironic combination if there ever was one. Still, he sat down and let me explain where I thought we should put all of our money, and he made suggestions.

More Posts on Bugeting:

- Broke to Financially Woke Post

- What It Feels Like to Forget It’s Payday

- 5 Ways to Save Money for Travel (One Day!)

Then, I implemented some changes in the way we budget so that we could truly remain one month ahead in our budgets.

I Created a Wish List.

A Wish List is simply a way to make priority decisions about the upgrades you’d like to make in your home (or life, I guess). You list all of the things you’re saving for, and prioritize them. What’s most important, then what’s second most important, etc.? You can save for them in any order that you wish, but it helps you make decisions as a family on what you’d like to buy.

Mr. ThreeYear and I have saved up enough for a piece of bar furniture we were going to put in our music room. We were going to get it from IKEA, but IKEA is now closed, so we haven’t gotten it yet. So the money is sitting in its account, chillin’, until we can buy the piece or find another one somewhere else.

The designations in front of the items, S, M, and L, simply stand for how much we need to save for the item–is it a small, medium, or large $$$ goal? Will it take beaucoups of dollars or only a few slight shaves off our backs?

If we decided there is something else we want to add to the list, we add it! We just have to decide where it stands on our list of priorities.

With the wish list, I feel like we have a better handle on those illusive bits of money that seem to disappear without a trace. Once our goals have a name, we will do anything we can not to transfer our wishlist money to another category.

I Input Expenditures As Soon as They Happen

Have you ever gotten a sum of unexpected money, then spent it five different ways before it hit your bank account (perhaps that stimulus check?). I overspend this way all the time, thinking, “oh, we can go out to eat one more time this month, because I can cover the shortage with the $XX coming in.” The problem is, I then forget, and spend the $XX another way. Whoops.

This month, I’ve been keeping my receipts and inputting the expenses while they happen. Of course it’s a lot easier since I have a lot more free time on my hands, but it really does help me see, in real time, what is left in each account. Then, when the expense is automatically imported from my bank, I just match it to my manual entry.

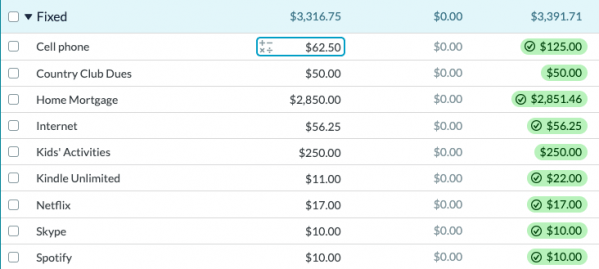

I Don’t Touch My Fixed or Periodic Expenses

I moved all of my fixed expenses to their own category, and after I have budgeted for the month, I close that entire tab, since I know that the money for those expenses cannot be touched.

Another thing I did was move all of our periodic expenses to their own category. Then, I looked back at last year and saw how much we spent on average in each of these categories, and then I budgeted that amount for each periodic category, so that hopefully when the expense comes around, it will be budgeted for.

This is Budgeting 101, but since we moved, I have been paying these expenses month-to-month, just because of a lack of planning on my part. Now, I am closing up our Periodic Category as soon as we fund it, too, so that I am not tempted to use any of that money for current expenses. I am hoping that this will really help our cash flow a year from now.

It feels empowering to be able to put aside little bits of money in these categories and not touch it. I am very grateful we are on lockdown and spending less because that has helped the process.

Thanks for sharing! I like hearing about the progress you’re making and how you re-configured your budget. I love the “wishlist” idea, because it gets some of your priorities in writing so that you can remember those when you’re tempted to buy things that really aren’t your priority.

Being able to say, “I’m not good at this”, and then trying something new to improve already puts you in an elite category, Laurie. Budgeting can be tough to begin with because it involves pitting our longer term hopes and plans against the immediacy of what we want now (i.e., expensive sushi when you’ve got that craving).

YNAB is a great software. I purchased it a good while back and though I haven’t been using it over the past while, I like the approach. You can have anything, you just make a plan for it. I’ve never been a fan of budgeting through guilt where you must have all “needs” covered before even considering a “want”—life’s too short.

Keep up the progress and you’ll eventually be many months ahead!

Take care,

Ryan