If you’re just joining, our family of four is on a three-year journey to double our net worth and become location independent. Each month, I record our progress on our net worth and our spending (gulp!). This year has been a year of fixing our house (the roof) and paying off debt, plus saving as much as possible. As of October, we were roughly 24% of the way to doubling our net worth.

At the ThreeYear house, we’re in the midst of colder temperatures (it’s currently 21 F/-6 C). Our Christmas decorations are up and we’re enjoying the few weeks of winter until we pack up and head to South America for a few weeks, where we’ll enjoy delicious summer weather.

It’s hard to believe that the end of the first year of our experiment is coming to a close. It’s been amazing to document this journey on the blog.

November was a month of higher expenses. We had my family in town, so we did some home improvement projects related to that. And we stocked up on food. My mom very generously donated money to our food costs, which I put into our savings account. Yay for extra savings! We started buying Christmas gifts for our family in Chile. We had a second month of high medical bills. For next year, we’ve switched our insurance from the high deductible to the higher cost, everything-is-covered policy. 2017’s experiment with the high deductible healthcare didn’t work for our family. Between physical therapy, psychologist visits, braces, and managing our sons’ ADHD, we pay a lot in medical costs. It would have been cheaper to pay the higher bi-weekly premiums and have less to pay out-of-pocket. Mr. ThreeYear will also rest easier knowing that whatever medical issues life throws at us, they’ll pretty much be covered by our healthcare plan. When he developed tennis elbow and decided not to pursue any more physical therapy because of the cost, it was a pretty frustrating situation for him to be in.

We know that December will also be a very high spending month, because of our Chile trip. We’ll also pay the remainder of our church tithe (which doesn’t show up in our monthly spending report, because we want to keep our giving on the downlow). We’ll pay off the Prius and the apartment in Chile, pay a little extra on our mortgage, and pay our house taxes.

We’re grateful that we only have one more month of monthly payments for our apartment in Chile and our Prius!!

Our Progress

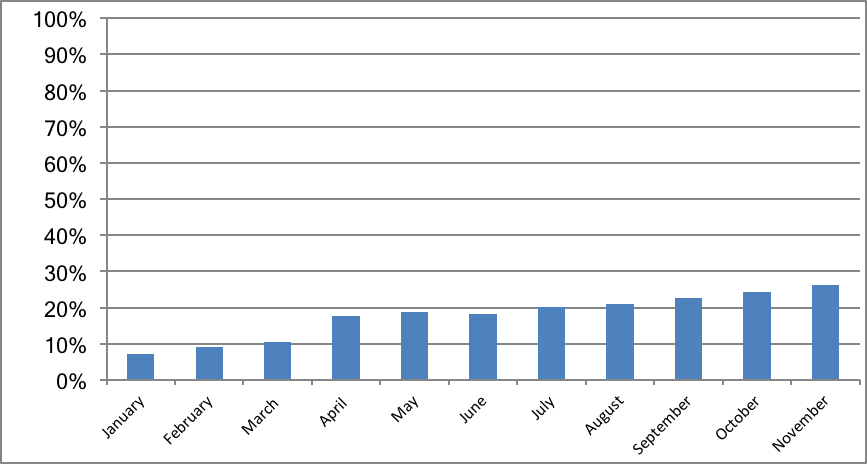

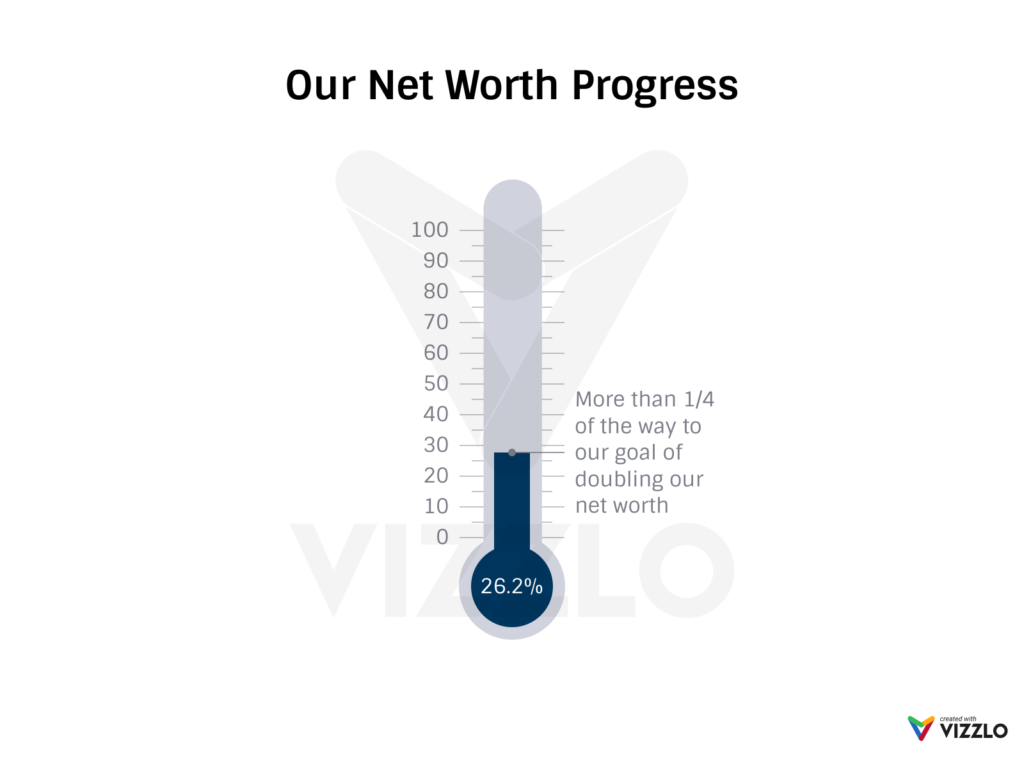

As of November 30th, our net worth has increased by a total of 26.2% from our starting point in December of 2016. In order to hit our goal of doubling our net worth in three years, we’ll need to increase it by an average of 2.77% each month (or 33.33% by December), but we know that progress won’t be completely linear. We may not quite hit our 33.33% goal for this year, but we hope that the increase in investment income and growth from that will make up for it in Years Two and Three (but if the stock market drops precipitously? Well, we’ll see). Our net worth increased 1.8% from last month, but we hope the increase in December will make up for that, when we pay off the last of our debt payments with Mr. ThreeYear’s end-of-the-year bonus.

Here’s a graph to track our progress:

This is as a percentage of our total goal:

Spending Update

It is perennially difficult for me to include our spending in these reports because it’s so high compared to other personal finance bloggers. But there’s nothing quite like publishing these figures to keep us honest. And I think publishing our spending will eventually change our spending habits. What can I say–I’m an eternal optimist!

NOVEMBER SPENDING:

Housing: $2281.99. This includes the house mortgage (15 year mortgage) and the apartment in Chile, which we plan to pay off next month.

Prius payment: $263.71. Will be paid off next month.

Gas: $161.24.

Groceries: $1063.81. I was hoping this month’s total would be lower. But, we bought a lot of groceries, wine, snacks, and other specialty foods for my family’s visit. Luckily, we have a lot of food left over that we can eat this month or freeze for later in the winter (turkey casserole, anyone?).

Eating Out: $190.70. This higher-than-usual number includes just three memorable meals: a special family breakfast at a diner with the boys, dinner at Worthy Kitchen with my sister and brother-in-law, and a girls’ night dinner for me. We’re trying to keep our eating out expenses close to zero, but if they include special experiences (versus grab-a-burger-and-go), then I don’t mind as much.

Household goods: $18.22. Something from Wal-mart.

Kids’ expenses: $20. Just the drum rental this month. We opted not to continue swimming lessons through Christmas, since we would be leaving so early in December, and because we had so much to do to get ready for our trip. It’s turned out to be a smart move!!

Entertainment: $13.30. This includes drinks at Laser Tag (which my father generously paid for) and coffee with Junior ThreeYear at Starbucks, after a movie we were trying to go see sold out.

Amazon Prime: $99. We have an annual membership.

Mr. ThreeYear’s spending: $357.58. This includes several Black Friday purchases. Mr. ThreeYear found a laptop for $100 (he needed one since he has given me his MacBook for my blog!) and a $99 monitor.

Mrs. ThreeYear’s spending: $107.98. I paid for this season’s Yoga Lessons and our Google storage space.

Babysitter: $30.

Clothing: $365.62. Argh! What happened here? A pair of shoes for Mr. ThreeYear, a new pair of running shoes for moi, a trip to the Darn Tough sock sale to replenish our sad store of winter socks (Darn Toughs are amazing! I’m never buying any other type of winter sock!), and several other purchases at TJ Maxx, including pants for the boys. We’ve spent very little money on the boys thanks to our fabulous hand-me-downs, but given Little ThreeYear’s propensity to put holes in his pants, we occasionally need to get him a new pair of jeans.

Cell phone: $0. This was still $50.23, but I realized that because I use my cell phone pretty much every day for reasons related to ESOL, I can write this cost off. Yay! I’m so glad to be a contractor.

Internet: $104.96. This stays the same each month. I keep asking Mr. ThreeYear to let us get a cheaper (and admittedly slower) plan, but he’s not biting.

Electricity: $135.31.

Propane: $452.11. We’re paying for our propane as it’s delivered this year. Grateful for a warm home.

Haircare: $22.95. One cut for Mr. ThreeYear.

Home phone: $4.09 through Ooma.

Home Maintenance: $199.13. Our monthly curbside compost service ($20), an air mattress, stove gaskets for our downstairs stove to help it stop spilling soot on the side of the house (it worked!), and two large purchases from Home Depot relating to winter maintenance.

Housekeeper: $180. We hired a housekeeper and she came and did a very thorough clean before my family got here, plus came once more. We are very glad to have found a reliable and efficient person to clean our house.

Gifts: $348.77. This includes baby gifts and Christmas gifts. We’ve continued to buy gifts for our family in Chile who we’ll be visiting in December.

Medical: $588.60. We opted to get the high-deductible health insurance this year. It was an experiment that just didn’t work for us. We’ve had lots of medical expenses for various reasons, and have switched back to the standard plan for next year.

Total: $7009.07! We spent $4727.08 without mortgages included.

I’m looking forward to publishing spending reports in the new year, to see what the effect of lower medical costs, one less mortgage, and no car payment will be. If you’re wondering how we were able to pay off $38,000 in debt and build a high net worth in less than ten years, read more about it, despite lots of mistakes and a late start, here. (Part of our success comes from keeping spending low on our housing and cars).

Let it Snow

Now that we’re well into the first week of December, we’re patiently waiting for our first big snowfall (because usually in December, they stick!). We’ve got our ski passes and are ready to hit the slopes, and a few big snowfalls would be icing on the cake! But we don’t have very long to ski before we leave for our big trip to South America, where we’ll be enjoying summer weather. We’ll spend Christmas and New Year’s with our family there, and I’ll blog about our adventures along the way. As always, we’re optimistic for the future and excited to see what Year Two of our experiment holds.

How was your November? Hope you’re having a good December!

Nice November Laurie! And a great net worth improvement too! Congrats! That’s huge for just one year!

It’s hard for me to move the needle that much anymore… It’s a good problem to have I guess. 🙂

Thanks Mr. Tako! I’ll be very, very excited when our net worth needle moves as slowly as yours… we have a ways to go to catch up with where you are now but we’re working hard! 🙂

Nice progress, Laurie! And that dinner looks delicious 🙂 Here’s to snow!!! (c’mon winter!)

I agree Mrs. AR! Ready for it!! 🙂 Looking forward to seeing your beautiful backyard covered in snow!

Congrats on the progress, it’s been a good year! Sounds like a smart move to go back to your standard medical plan.

Yes, I think for us, there’s no question any more. I’m glad we had the opportunity to do it! Now, we know what those costs will be for next year! The uncertainty of all these huge medical bills coming in was getting really frustrating.

Awesome job Laurie, keep it up!

Thanks so much, Liz!!

Wow, an increase of over 25% is no small feat. Well done! 🙂

Thanks Kristine, and thanks for visiting!

I was just writing up a draft on an expenses report and felt the same way. My expenses are closer to yours than the average PF blogger and that made it hard to write. So thanks for sharing. Even though I logically know there are others it is nice to see.

I’m glad to hear that other PF bloggers are in the same boat! Thanks for visiting, Coraline!