Our family has been planning to become location independent and move for a while, now. Our dream is to double our net worth by the time I’m 40, and find jobs that will allow us to travel more, split our time between two continents, or live in a foreign country for a few years. Because… we only have one life, right? And the kids will be little for like ten more seconds and then they’ll be grown… but making the decision to sell our house? It’s not easy.

One of the reasons we travel so much is to remind ourselves that there is another way to live than the way we currently do. We are a family of habit, and it’s easy to become so immersed in the routine of our daily lives that we never question our decisions or habits.

But one question that Mr. ThreeYear and I have had nagging at the back of our minds for a while now is… should we sell our house and find a smaller place to rent?As I wrote about in The Best Way to Avoid Lifestyle Creep, keeping your housing costs low is key to financial independence. And we’ve had the unsettling suspicion that our house is a little too big for us for awhile.

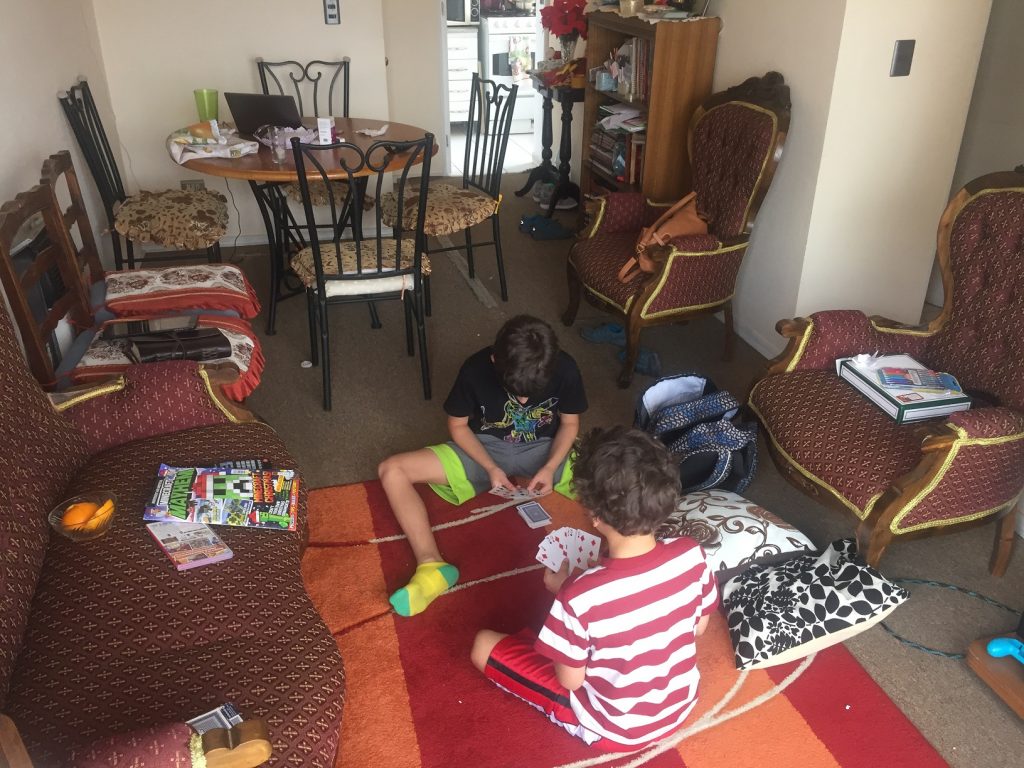

After we got back from Chile last week, that suspicion was confirmed. We spent most of our time in Santiago staying in a less-than-600-square-foot (52 sq. meter) apartment. It was small, and with three bedrooms and two bathrooms, was extremely space efficient. Yes, it was a little tight sometimes, and cooking was a bit difficult. But there were definite benefits, as well. One benefit was the shared space. We were able to go downstairs and use the common areas for the Junior ThreeYears to ride their scooter, or swim in the pool. There were tons of other kids playing, too, and while there wasn’t a lot of interaction, because of the language barrier, that would definitely change if the kids had spoken the same language.

While we were in the apartment itself, we didn’t get in each other’s way, surprisingly. The boys each had their own bedrooms, and they’d take their few toys we had packed and go play or read in their rooms. We did homework each morning on the small round breakfast table, then would move the school books to another part of the apartment when it was time for lunch. I even lost Junior ThreeYear in that tiny space at one point! (He was on the balcony, reading, and I didn’t see him because of the curtains).

The thing that was so nice about the small space was that we were together, we were cozy, and we were able to enjoy each other’s presence. Our current house is so big that we can’t see or hear each other when we’re in our rooms, and it can feel lonely. Most of our time is spent in the common area, our dining and living rooms, which are basically one big space (and are larger than the entire apartment in Chile, by the way).

Little ThreeYear has grabbed my hand at several points since we’ve been back and asked me to come with him to some remote part of the house, “because I’m scared to go to the basement alone, Mama.” Our basement, by the way, is not a dark, bare-boned forgotten space in the bottom of the house. It is finished, carpeted, and filled with Little ThreeYear’s toys, as well as a comfy couch and chairs. But after all that togetherness in Chile, Little ThreeYear feels lonely in the vast swath of basement without another person.

But does it make sense to sell our beautiful home, which we bought in a short sale at a very good price, with its spacious backyard, forest hiding-spots, and ample space for visitors, to move to a condo with no garage (a huge negative during New Hampshire winters), much less space, and community fees?

First, let’s consider the idea from a purely financial perspective. Let’s consider the cost of selling our current house and renting a condo in a nearby planned community.

The Numbers

| House | Condo | |

|---|---|---|

| Total Cost of Mortgage/Rent Per Year | -$21,300 | -$19,200 |

| Property Taxes | -$7433.85 | $0 |

| Increase in Net Worth OR Investment gains (assuming $150K invested at 5%) | $15,000 | $11,700 |

| Maintenance Costs | -$3,000 | $0 |

| Tax Benefits (for 2017 only) | $2296 | $0 |

| Total Yearly Cost: | $14,438 | $7,500 |

Here we see that the cost of owning a home is almost double the cost of renting, without considering the associated costs of utilities and housekeeping that would also probably go down. The first number shows what our total mortgage insurance and its cost is per year (we have 9 years of a 15-year mortgage left to pay). As you can see, the condo rental costs would not be much less than our current mortgage, although I’ve assumed $1600 per month rent for the condo, which is on the higher end (aren’t rents crazy expensive here??!).

The second number is what we currently add to our net worth in terms of principal pay-down on our mortgage. The number on the right represents what we’d probably earn in investment gains each year if we sold our house and invested the profits (again, I’m estimating our probable profit after fees are taken out, and I’m estimating low).

The maintenance costs represent what we spend on our house when we don’t have a large project, like a roof, to tackle. Our maintenance costs in 2017 were a bit higher–$17,130, to be exact.

Ok, but let’s not forget the mortgage interest deduction on our taxes–oh wait, that goes away next year with the new tax bill and the higher standard deduction of $24,000 for a couple! Well, anyway, for this year, it will be approximately $2296, so let’s figure it in for the sake of fairness.

Even with these conservative estimates, it’s clear that owning a home is more expensive than renting a condo. But these cold, hard numbers don’t represent the benefits of living in a house. So what are the benefits of a larger space, as we see them?

Benefits of Our Home

- large backyard for planting a garden, digging holes, hiding in the forest, riding bikes, having large parties

- attached garage so that we can park our cars and walk inside without getting wet/ cold/ snowy

- plenty of space to have our entire extended family to visit

- room for all of our furniture

- impressive/beautiful home

- lovely gardens

We have a nice home, and it’s a great space for entertaining and having friends come visit. But how often do we do that? We entertain on a large scale maybe 6 times a year, and friends and family might come visit once to twice a year. During the rest of the year, we’re constantly spending our weekends cleaning up a house that gets messy at the drop of a hat, or thinking about the repairs we need to do because there’s always something to repair in a house this large.

What would be the benefits of a condo, for heaven’s sake, if any? Well, there are a few. If we moved to a condo in the shared community in our town, we’d have the following:

Benefits of a Condo

- Our backyard would include walking trails around a lake, a covered bridge, and bike paths

- We would have access to a gym, heated pool, and community center at no additional charge

- In the summers, we’d have access to the lake and playgrounds and could meet up with friends every day to swim and play

- Less house to clean/maintain

- No outside area/garden to maintain

- Snow removal/ trash removal/ parking lot maintenance provided

- No house to sell when we eventually move!

We would benefit from a shared space that is maintained by the community association. There wouldn’t be any flower beds to constantly weed and take care of. But we’d have ample gardens to enjoy. We’d have walking paths, cleared all year round, right outside our door. And no less than four lake shores to enjoy in the summer with friends (because many of our friends live in the community).

So as you can see, living in a condo does have its perks.

What if, however, we didn’t sell our house and rent? What if we sold our house and bought a condo? Let’s look at the numbers there:

| House | Condo | |

|---|---|---|

| Initial Investment | $0 | -$130,000 |

| Total Cost of Mortgage Per Year | -$21,300 | $0 |

| Association Fees | $0 | -$3,000 |

| Property Taxes | -$7433.85 | $-2,470 |

| Increase in Net Worth OR Investment gains (assuming $20K invested at 5%) | $15,000 | $1,000 |

| Maintenance Costs | -$3,000 | -$1,500 |

| Total Yearly Cost: | $16,734 | $5,970 |

Here are our assumptions. We’re assuming we’ll net $150,000 with the sale of our house. We’re also assuming we will spend no more than $130,000 in the sale and fixing up of a condo (foreclosed condos with 3 bedrooms and 2 baths have sold for as little as $66,000, but that’s rare. It’s probably more likely that we’d be able to buy a condo for around $100,000 and spend $30,000 in fixing it up).

So that would leave $20,000 to invest. We won’t have any yearly mortgage fees, but we will have property taxes and association fees. Because the property is much smaller, taxes look like they’ll be about a third of what we currently pay. But association fees will keep going up, year in and year out, and we will have no control over what we pay.

Renting it Out

So why would we buy a condo if we’re preparing to become location independent? It seems like it would tie us down even further. Well, it turns out, a condo might be a good real estate investment.

If we use the 1% real estate investing rule, which states that a rental should give us at least 1% in rent per month of the total cost of the investment, then a condo would fit the bill. We would need to spend no more than $130,000 altogether on the property, including real estate fees, buy-in costs (currently a whopping $5,000!), and costs of repairs or upgrades to the condo. Currently, condos of this size are renting for $1,300 (with unfinished basement) to $1,600 per month. Larger condos are renting for up to $2,400 per month.

So a quick, back-of-the-napkin analysis says this option might be worth looking into. A condo, if occupied all year, could provide us with an income stream that could help fund our location independence.

Ok, now you’ve seen three possible scenarios for the ThreeYears:

- We stay in our current house and change nothing.

- We sell our current house and rent a condo.

- We sell our current house and buy an investment condo to live in for a few years and then rent out.

Of course these aren’t the only scenarios, but they are the ones we’re considering right now.

What to do, what to do? What would YOU do if the decision were yours?

Hello Laurie, interesting question for the location independents you raise there, here are my thoughts :

1) I would move out of the house and go live in the condo it offers all you need with the nice common areas. And will save you time and energy with repair and maintenance.

2) Can you rent out the house? What are the numbers saying there? You could still keep it if the numbers are good or if you intend to come back at some point.

3) Buying the condo seem like a great option to me : You are still building up net worth through the years and in case you move around it can be rented out with a cash-positive outcome.

In short whatever you do : Move out of the house and go live in the condo 🙂

Thanks for these great thoughts, Joney! We’ve looked into renting out the house, but with the property taxes, we wouldn’t be able to rent it enough to cover our costs. Plus, we’re not planning on moving back, so it probably wouldn’t make sense. I agree that buying the condo seems like the best financial decision, and long term decision. We’re eventually going to be moving, anyway, so this would be a good test run.

Hello again. Then get rid of the house, trust me I have emotions attached to my appartment in Norway as well I however had some about my appartment when living in Paris but since I got a nice home there as well it was easy to view my appartment in Oslo as “just an investment”. If it was too much of a hassle I could easily sell it as long as I found a nice home somewhere else. BTW : I have started to apply for jobs closer to my family in Belgium as I said in our interview, so that is also why I looked into this article.

Wow! That’s big news. Congrats and good luck! 🙂 Sounds like you might keep the apartment in Norway?

Oh man, so many thoughts. Here you go…

House:

– personally, we really enjoy our house, but we are self proclaimed “roots” people (vs. “wings”). We want to settle in, plant deep roots, become ingrained in our local community and live life here. Sure, we’d love to travel a bit, not no real desire to travel long term or live internationally (at least, as things stand now)

– However, if we were “wings” people, a house would be a tougher sell. They are expensive! We are ok with this expense because we want to be here forever. If that wasn’t the case, we would second guess all the work for something more temporary

-when we lived in CA, we had a hard time balancing the desire to invest time/money to make our living space homey, all the while knowing it was a “sunk cost” since we wouldn’t live there forever. The temporary feel was hard for us. That would likely not be the case if we had lived in a Condo where grounds were kept up by others 🙂

Condo:

– For travel, this seems like it might be a really good idea. The ability to downsize, rent out when you are gone, and essentially “outsource” the physical upkeep of the grounds seem like huge perks. And the ability to have community resources (gym, pool) is awesome with the kiddos.

No real answer since I am not in your shoes, but if you are looking to downsize, embark on long term travel and maybe simplify a bit, the condo does seem like a really good option 🙂

Thanks so much for all your thoughts, Mrs. AR. You encapsulated so many of the emotional considerations about selling the house with your comments. I think that’s the hardest point for us–are we giving up our roots in the community in which we’ve lived so long? Well, yes, we are, and have planned to for a while, but actually doing it is a lot harder than just talking or writing about it. There’s also the part about giving up our status and the status our house brings us in the community. It’s not that I’d miss our house, per se, but that I’d miss being part of our neighborhood, and having a large space to host family and friends. I know that sounds perhaps trite and unimportant, and it is, in the long run, but it’s something that’s currently a struggle. If we think long-term, though, and take the emotions out of it, I think the condo makes perfect (logical) sense.

Given the transaction costs in real estate transactions I’d probably stay put until you decide exactly what your mid term location independence looks like. Financially the large house is a bit of a drag but 6 percent on both ends can cover a lot of things.

Good point, FullTimeFinance. Real estate transaction costs would be around $20,000, so we have to consider that cost in the decision.

my 2 cents 🙂

1) How is the selling market for the house? All of *our* house values (3 across the US) seem to be slowly creeping down, but they are still valued quite high for what they are (in my opinion). In 1-2 years (or when you retire) do you think you’ll still be able to offload it for a good price, or do you think prices will drop?

2) I like that the condo meets the 1% (+) rule. You already have experience with rental properties, which is a major plus. If you do turn it into a rental, I also really find it valuable to live in the unit before you rent it out for several reasons (which we’ve done for all 3 of ours): you intimately know what’s going on with it – when the property manager calls, you have an idea of what’s going on (i.e.: just have the tenants flip the breaker, that usually fixes it; or spray some WD-40 on the right roller and the garage door will stop making that noise; or, yeah, the heater does that sometimes, try this). Also, those neighbors you are friends with help keep a lookout for you. When something is fishy, our ex-neighbors call us…i.e. when water is gushing out the front door, or someone is trying to climb in through a window and claims they rented the house, but the neighbor knows another family is living there already (good times! though to be fair, we’ve gotten a few phone calls from neighbors saying they just love the new tenants – it’s not always bad news 😉 Another great thing about condos: you, the tenants and the prop. manager only have to deal with the inside: your new roof takes on a whole other dimension when it’s a rental and you and the hubs are somewhere else.

3) I *just* finished reading frugalwood’s reader case study, and the gal was really attached to her beautiful house (I’d be attached to it as well….hell, I am attached and I’ve only seen 3 pictures of it! it’s gorgeous, haha! ). But, you don’t seem overly attached to yours – which makes the transition that much easier.

My vote: sell the house and buy a condo with the intention of future rental income.

Thanks for the thoughts, JP! 🙂 To answer your questions/comments, 1) house prices seem to be slowly increasing in our area, so I feel confident they’ll stay the same or increase slightly in 1-2 years. 2) Those are really good points about the condo. The fact that we wouldn’t have to replace the roof on the thing is a selling point in and of itself. Wow–the stories you have about your tenants! You make great points about living in your property/knowing it and your neighbors well before renting it out. I hadn’t thought of those considerations but they’re huge! 3) You’re right, for whatever reason we’re not so attached (maybe because I’ve always wanted to move back to the South and see the house as getting in the way). I appreciate your advice and experience!!

It’s great if the potential condo meets the 1% rule.

If you are not emotionally attached to your house and are up to keeping the condo as a rental in the future, I would go with #3.

Thanks for the feedback, Caroline! It would definitely be a bit of an experiment to take on another rental but I think it could be a good learning experience and potential source of cash flow. Before we bought anything, we’d definitely run the numbers carefully to make sure it makes sense as an investment.

How’s the local real estate market in your area? If it’s favoring sellers a lot I would take advantage of that. In situations where I’m not sure what to do I stay put like #1 and go with the cheaper, less work involved solution, whichever that one may be.

Lily, thanks for the advice. Yes, #1, staying put, would be a lot less work for sure. The market is not really favoring sellers right now; is it possible to have a neutral market? I think that’s what we have.

Laurie, I think you have set your mind what to do with your house. Its always the cost of owning a home is higher compare to the cost of renting. But there is a secure feeling you have in your own property.

Hi Elfriede. You make a good point–it’s definitely a different feeling to own your own place versus renting. It’s much easier to talk about what to do than to actually do it! I think we need to take some time and sit on it. Good thing we’re not in a rush!