Earlier in the school year, Little ThreeYear was really struggling. He has some learning issues, and moving to a new school almost put his brain on overload. The problem was, he couldn’t focus on anything, so he focused on absolutely nothing, and refused to do his work.

During those difficult few weeks, I wrote these words.

You want to do anything you can, anything, to lesson their struggles. Even though I know that some struggles are good for a child, I’ve watched my son’s square peg be wedged into school’s round hole for ages now, and it hurts. It hurts to watch him cry out, “I hate school! I hate everything about it!” It hurts to know that he’s just not happy and will never be happy being forced to sit and do endless math problems in order to prepare himself for state mandated testing.

Another part of me knows that there are things in this world that you just have to suck it up and do, and school is one of them. Yes, it’s hard and purposefully dull and boring, to prepare you for employment. I hated parts of school even though I was an excellent student, Mr. ThreeYear hated school (and wasn’t an excellent student). We both made it out okay.

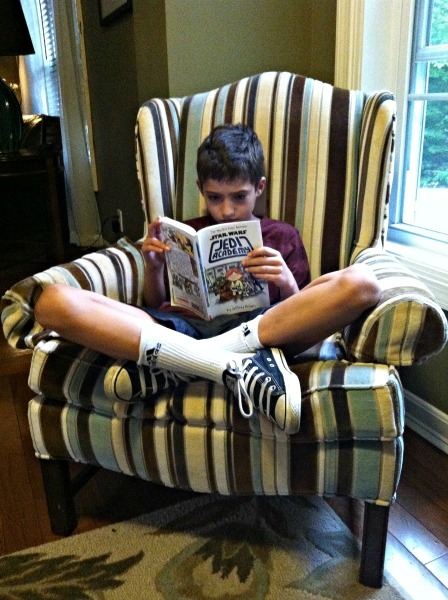

But on the other hand, a small voice inside me keeps asking, “but wouldn’t he thrive in an alternative environment, like a Montessori school?” Junior ThreeYear is a maker. He builds and plans buildings, Lego sets, paper dolls, forts, comic book series. He can focus for hours on a project involving any of those things. But he completely tunes out his teacher and stares off into space during math, to the point where he struggles to complete a few problems. It drives his teachers crazy. I understand; I’m a teacher. I also know he’s not doing it on purpose. He just isn’t interested and can’t make his mind focus.

He has counseling, he has meds, he has OT tools. None of it is working.

So now what? What do we do now? Private school is not in our FI plan. It’s expensive. Can we afford it? Yes. Should we afford it? That’s the nail-biting question. I don’t know. We go back and forth, “this would be an amazing experience.” “What if he doesn’t do well here either? What a waste of money.” “You and I sucked it up and got through it.” “Will he be prepared for high school?” “Will we be able to save enough for college?” “I’ll have to go back to work earlier than I wanted.”

Shortly after I wrote this panic-stricken missive, I sat down with his teacher, the vice-principal, and a wonderful counselor who’s been at the school for 30 years. The counselor introduced a small little “tweak” in Little ThreeYear’s day that has produced a dramatic turnaround in his productivity.

It’s a checklist.

If he does all of his morning work, and earns nine checks, he gets to go hang out with the counselor and build Legos for fifteen minutes just before lunch. In the afternoon, he has the same deal.

In addition to the fact that he now gets his work completed, he is also learning (miracle of miracles). His performance on those awful standardized tests I mentioned increased an impressive amount in four months.

What if Mr. ThreeYear and I had panicked and pulled him out of school to put him into a private school? We would have spent upwards of $1,000 per month to put him there. Times nine years.

My neighbor is currently in the same boat. Her boys attend a local private green school but her oldest is having a lot of trouble with reading. A private school recommended she hire an expensive tutor (at $120 per hour!) to help him for six weeks. She’s very worried about her son. I suggested she check out the public school, sharing my experiences about Little ThreeYear.

Why was I contemplating making such an expensive financial move, effectively tanking our frugality, and why is my neighbor contemplating the same? Surely there are other, less pricey ways, to get our kids taught?

Hot State versus Cold State

Dan Ariely, in his book Predictably Irrational, talks about our tendency to not be able to predict our reactions in a “hot state” when we’re in a “cold state.”

“Even the most brilliant and rational person, in the heat of passion, seems to be absolutely and completely divorced from the person he thought he was. Moreover, it is not just that people make wrong predictions about themselves–their predictions are wrong by a large margin.”

For example, as I’m sitting here at my desk, calmly and cooly typing this post, I can tell you that there is no way I’d spend more than $12,000 a year to send my child to private school.

But when I was upset and angry because my child was having a miserable experience, and I didn’t know how to help him, then I seriously contemplated private school. I know because I have the words that I typed above to remind me.

We instinctively know that there are differences in how we act and think at different times. We have the phrase “cooler heads prevail” in our Lexicon, after all. But it turns out that we underestimate, while in our cool state, how much our actions and thinking change when we’re in a hot state.

Ariely continues, “the inability to understand ourselves in a different emotional state does not seem to improve with experience… we all systematically underpredict the degree to which [strong emotions] can take control of our behavior… although there is nothing much we can do to get our Dr. Jekyll to fully appreciate the strength of our Mr. Hyde, perhaps just being aware that we are prone to making the wrong decisions when gripped by intense emotion may help us in some way, to apply our knowledge of our “Hyde” selves to our daily activities.”

In other words, we should avoid making major life decisions when in the grip of intense emotions. Or we should consult others, those proverbial “cooler heads,” to help us think through our decision-making.

Related Reading:

- Financial Hot Buttons

- Can Optimism and Hope Increase Your Wealth?

- I Changed This One Habit to Save Over $11,000 This Year

Get Advice from Someone with No Skin in the Game

I remember when Junior ThreeYear was about to be born. Mr. ThreeYear and I were at the doctor’s office, and were told we’d need to head to the hospital across the street because I needed to have a C-section that night. It was our first baby, and Mr. ThreeYear was understandably very nervous. He wanted to make sure his car was at the hospital parking garage, so he called his coworker and asked if she could pick his car up for him, then bring it back the next day when we might need it.

“Or you could just drive it to the hospital and leave it parked in the garage overnight?” she suggested.

Obviously we took this sound advice. Mr. ThreeYear wasn’t thinking clearly, and I had my mind on the surgery.

In the case of Little ThreeYear, we talked to my parents, my sister and brother-in-law, and other friends about what to do.

We also waited. Our indecision (and distinct lack of interest in spending so much money on private school) made us wait a few weeks to see how things went. That ended up being very helpful, because Little ThreeYear’s school came up with its wonderful solution during that time.

My dad, a pediatrician, had recommended the same solution for Little ThreeYear back in first grade, and we used it with some success for several months.

But I’d forgotten about it in the interceding years. And during the time when we were so upset, we weren’t making thoughtful, well-measured decisions. Our emotional brains had taken over and our pre-frontal cortexes had taken leave.

Making decisions, especially about an educational issue, or a medical issue, is extremely complex and difficult. There are so many options, which makes making it that much harder to make a choice.

When we have a group of trusted advisors around us, like friends or family, they can help us navigate the myriad of options or provide solutions we haven’t thought of yet, like a checklist.

When life is going well, and we’re calm, cool, and collected, it’s easy to remain true to our frugal ideals and beliefs. But when one or two things start to spiral out of control, then it can be easier than we’d ever imagine to make poor decisions.

That’s why I have so much compassion for single parents who have so many emotionally fraught decisions to navigate. Or people with multiple jobs who are one disaster away from financial ruin. It can be easy to judge bad financial decisions from my cool state. But I should not, because I really don’t know how I’d react in their shoes.

Make a Plan

So how can we protect ourselves from ourselves? Ariely recommends avoiding any emotionally fraught circumstances, but that’s almost impossible (and he was talking about times when you’d be tempted to engage in inappropriate sexual situations).

Another way is to create strong boundaries for yourself before a crisis hits. For example, because we’d made it part of our identities that we make good financial decisions, we hesitated more strongly over the idea of private school than I think we would have if we didn’t have that as an identity.

If most of your extra money is automatically invested for you, then you don’t have it available to access for private school or tutoring. And you can make it a hard and fast rule during your cool state to never, ever, take money out of your investment funds.

What about for smaller amounts of money? Like when you’re sitting at your computer, and you get the “buy” fever? Many people have successfully implemented a “24 Hour Rule” where they wait a day before they buy an item.

Last week, when my son’s shoes broke (got chewed up by our dog), I had put two new pairs of shoes in my online shopping cart and was about to hit “Buy” before I remembered it was No Spend February and I promptly closed the window to erase temptation.

But there are limits to these boundaries, and sometimes, all of us will make poor decisions based on emotion.

All we can do is try to limit the damage as much as possible and get back on track.

Have you ever had a time when you made a bad financial decision in an emotional state?

Nothing at all on the same scale, but there was one time I got unexpectedly let go from a job. I was a wreck. I went home and thought about what to do. I figured that, hey, I can start working on a bunch of stuff around the condo that I had been meaning to do. I went to Home Depot and just bought a ton of random stuff. I probably spent $200 or so. Not a huge amount, but when I look back, I probably got around to doing less than half of what I thought I could accomplish.

Definitely wasted some money there. So, yeah, it for sure happens.

I’m so sorry to hear about that experience. I would have been a wreck, too! I’ve done things like that too, when my emotional instability led me to make some seriously dumb purchases in the name of “home improvement” or “life improvement.”