This post contains affiliate links. Please see my full disclosure for more information. Thanks for supporting the blog!

Today I have something a little different for you—an interview with economist Andrei Polgar of One Minute Economics. He’s just published a book called The Age of Anomaly.

He sent me a copy of the book to preview and I agreed to interview him for two reasons: 1. I was very impressed with the economic history contained in his book and 2. I think we don’t do enough preparation in the financial world for the Black Swan events that will inevitably come and can wreak havoc with our financial plans.

Now, if you’ve been reading this blog any length of time, you know I’m very even-keeled, and not prone to hysterics or emotional claims. But I’ve experienced enough in my life to be aware that things can happen out of left field that you’d never expect. My husband grew up in a dictatorship in Chile. Ordinary Chileans had no idea their land would be privatized and then General Agosto Pinochet would take over the country in a US-backed coup in 1973. My friend is Syrian-American. She could never have guessed that her entire family would flee her home country because of the bloody Civil War there.

Yes, I am American, and so I have that annoying American sensibility that nothing bad will ever happen to our country. And while we may never deal with civil war or dictatorship in our lifetimes, we may deal with brutal recessions or other unexpected economic events that can knock us off our financial footing. And so, this interview. I hope you enjoy, and take advantage: this week only Andrei’s book is $.99.

Hi Andrei! Can you tell me a little bit about your background?

I grew up in Eastern Europe, and currently live in Romania, in the second largest city there.

Even as a child I had these dreams of lemonade stands, things I saw in US movies and cartoons. I tend to like economics, being an entrepreneur, anything that has to do with financial stuff. I’ve always been pretty good with anything money-related.

I started a few businesses right out of high school, and things seemed to be going well, I was doing well financially. I started with development services, from article writing to web design. I ran three hosting websites. I ran an auction platform. I even had an escrow service that was sold to Escrow.com. I had a service for domains.

Then life happened. Essentially, this meant two things for me: First, my mom got sick and we don’t exactly have the best medical system over here. I took her to get treatment in another country. Needless to say, that takes a toll on your finances. Second, this all happened at the beginning of the global financial crisis of 2007-2008. And of course, that took its toll on my businesses. This essentially meant that I had to start from scratch, and it’s this experience that motivates me to make videos on YouTube, to write books, etc.

How did you become interested in economics?

I’ve always been interested in making money. The number one thing that made me jump into it was my personal experience. The realization that behind these numbers there are people, there are lives. I got my undergraduate, masters, and then PhD in Economics so I’ve been studying this stuff awhile. I quickly discovered on YouTube that I’m good at making complicated stuff easy to understand—statistics, standard deviation, etc. I’m good at teaching people economics in a way that works.

Tell me about your YouTube Channel, OneMinuteEconomics.

I basically just started it with the intention of maybe posting a video every one or two months. I started with basic concepts: inflation, deflation, etc. But people started to watch and suggest that I make one about this topic or that topic. One of my videos got featured on MSN. A month ago I saw my animations form an economic forum in Kenya. It is rewarding seeing people put your stuff to good use because it means that it works.

What do you hope people get out of it?

First and foremost, the idea that there’s no escaping economic decisions. Even not making economic decisions is an economic decision that is going to have real life tangible consequences. At the same time, though, I get that people have lives and families and stuff to do, so part of my value proposition is to give them the best bang for their time. If they just allocate a minute every couple of weeks, I’m going to do the best I can to teach them as much as possible.

Why did you decide to write the book, The Age of Anomaly?

I am someone who has made a name for himself with his balanced view. I’m not exactly an alarmist or a doom-and-gloomer. I would assert that when someone like myself starts being worried, it’s time to at least pay attention. And basically through my book it’s not my intent to get people in panicked mode or depressed, and instead I just wanna say, “Look I have these concerns about the economy.” I articulate them in the book.

I essentially say that for many reasons, whether it’s our excessive dependence on stimulus, on occasional injections of capital into the system, whether it’s the geopolitical implications, whether it’s the fact that cyclically speaking, we’re overdue a recession, for many of these reasons, there are many valid reasons to believe that a significant crash is coming sooner rather than later.

As someone who is someone who is involved in various volatile markets, I’m not someone who is easily spooked by a market crash. What I’m more worried about is what happens next.

Of course we’re going to have a crash. This is the business cycle. This is what sometimes happen. What I think, however, is that sooner rather than later, the narrative’s going to change. Because so far, whether we’re talking about the Dot Com Bubble, or the Great Recession, the Real Estate Bubble that popped, the narrative has been this: markets are crashing, people are panicking, but don’t worry. Central banks and governments have it under control. With each case study that passes, they essentially “save the day.” But, I believe we are at a stage when eventually the market’s going to say, “no.” Where essentially the market’s going to say, “I no longer have confidence in your ability to save the day.”

With the Dot Com Bubble, the Federal Reserve lowered rates to 1%. With the Real Estate Crash, they went down to 0% in the US, and even negative here in the European Union. After the Great Recession, they pumped up to $1 Trillion per year in America into the financial system. And just as some historical context, from 1913 when your third central bank, the Federal Reserve, appeared, up until the Great Recession, so, for almost 100 years, the monetary base was at $850 billion. So essentially more money was injected in one year than had existed after almost 100 years of central banking.

What are some of the anomalies that people could expect to happen in the coming decade?

It’s not so much the anomalies that people can expect to come as much as it’s about the anomalies that exist today that are going to trigger certain events. So one I’ve mentioned, our overdependence on cheap money, on financial stimulus. Two, geopolitically speaking, and once again this is something that’s happened throughout history, there is this widespread tendency of going after a financial crash to having currency wars. Countries trying to weaken their currencies so as to boost their exports. We have already had that, after the Great Recession. And again, historically speaking, as is happening right now, those ultimately lead to trade wars, on countries embarking on protectionist measures, each country of course with the intention of helping its own economy. The problem is that when everyone does it, at least so far historically speaking, with the most popular example being what happened after the Great Depression, it doesn’t really lead to great stuff. Third, there’s the cyclical element, the fact that only once has it happened actually that more time has passed between recessions than right now. If another year goes by without us having a recession, it would be a record. From this perspective that’s another reason to be concerned.

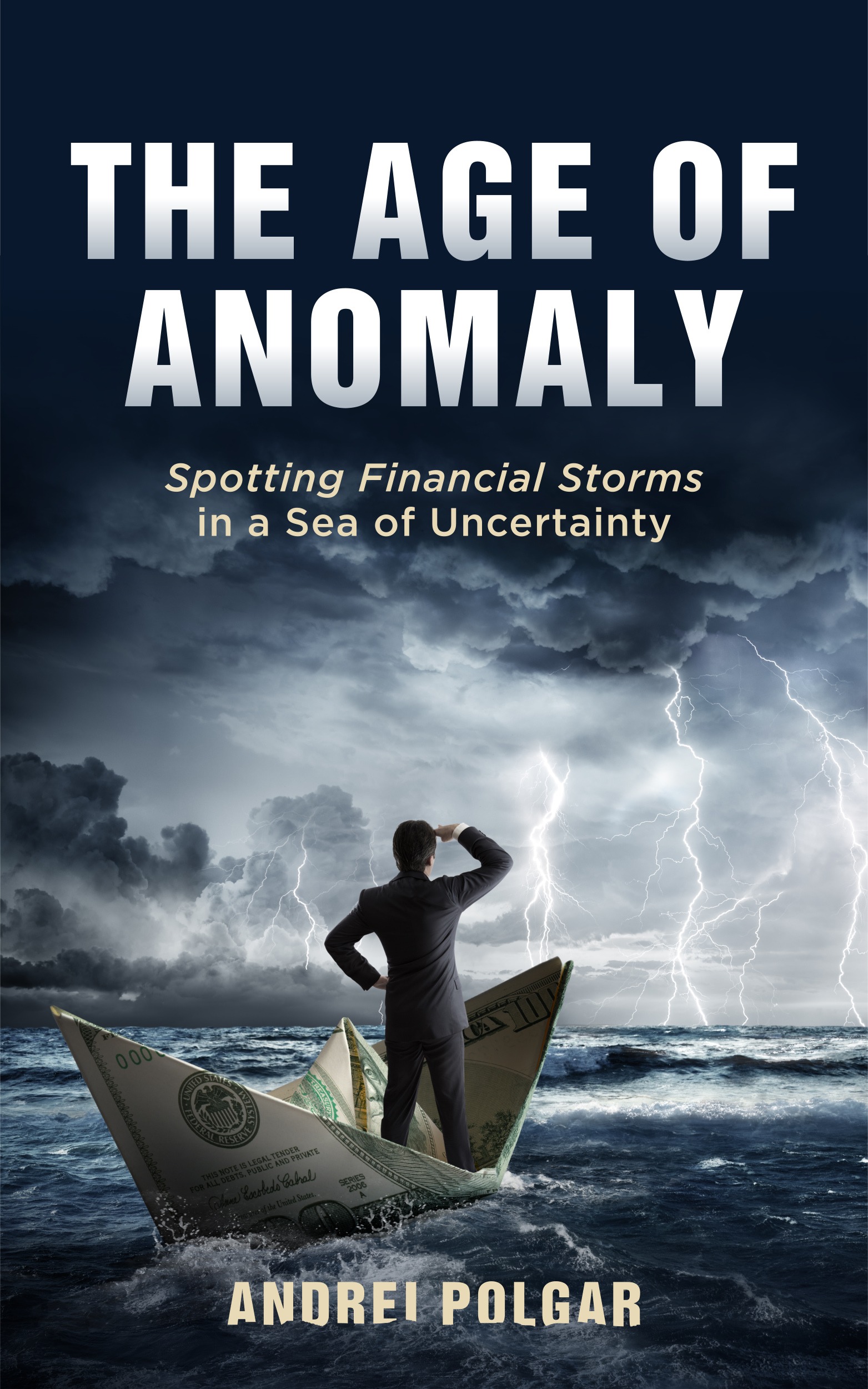

And individually, these are just three examples, but individually these are all causes for concern. This is the cover of my book, there’s a guy sitting in a boat with storm clouds gathering on the horizon. I think this perfectly describes our situation. Because if we look at things collectively, we cannot help but see that there are some major storm clouds on the horizon. There’s nothing you can really do about it to stop what’s coming. These are bigger than you and have you to come to terms with it.

What you can choose, however, is how to position yourselves. What I tell people, is that it won’t be pleasant. People are going to lose jobs. Families are going to have huge financial difficulties. So I’m not guaranteeing you huge, amazing financial prosperity just by reading this book. What I am promising, however, is that if you actually put these tips to good use, the likelihood is very high that you’re going to land on your feet. And I think that’s a very fair value proposition to make.

What are some ways that a financially literate person might go about preparing him- or herself for unknown economic, socio-political, or even climate events?

First of all, even if you are financially literate, always be willing to brush up on your economic history. Also, stay on top of current events. Then, you’re going to watch the news and say, “Wait a second, this happened a hundred years ago and it led to that. Something similar happened two hundred years ago and it led to that. These two dimensions—financial history as a reference point, coupled with a willingness to stay on top of current events—is huge.

The second part of my book is where I try to teach people how to not be one-trick ponies. I go through all of them from traditional stuff: real estate, bonds, traditional stocks, and even lesser known ones, like domain names, crypto-currencies, and peer-to-peer lending, and I do this with the intention of getting people accustomed to the idea that you don’t have to pick sides.

Let’s assume that you’re an average family that lives in a company like Syria. Maybe you’re an engineer; your life partner is an accountant. What is your wealth? Your wealth is your real estate, maybe you own $10,000 of precious metals, and maybe you have one Bitcoin that you bought at absolutely the worst time. You bought it in December of last year when it was at $20,000. Then assume something bad happens in your country and you’re forced to flee. Something like a civil war. What that does to your wealth is this: your real estate essentially goes to $0, because you have to leave it behind. Your car is also going to go to $0, because you’re not going to be able to take it with you from Syria to Germany or whatever your destination country is. Your precious metals are portable, but the likelihood of having them confiscated at the border, stolen from you, or otherwise taken away, is very high. So this is an example of a scenario that even that one Bitcoin that you overpaid for might be enough to get you a new life.

What if you lose access to the internet? In that case, I would much rather be holding some precious metals than crypto-currencies. This is the message I’m trying to tell people. You don’t have to pick a side. What I want is to turn people into logic-driven economic thinkers so they can make their own decisions. Essentially, after reading the second part of the book, they’re going to know exactly what they want to invest in, they’re going to know why they want to invest in each asset, it’s going to be firmly entrenched in their subconscious, and it’s going to become second nature to them, to eventually have exposure to all these assets.

None of this is rocket science. As long as you’re willing to put in a little bit of work, you’re going to be in good shape. That’s why whether we’re talking about economic history or hands-on tips or asset-class analysis, I did my best to make sure that I had all bases covered, so that in the end, people can have the big picture, and think for themselves. That’s my only goal, essentially.

Where can readers find you?

I’m easy to get ahold of. Leave a comment at my One Minute Economics channel on YouTube and I’ll write you back. The book is available in digital and print in Amazon, Barnes & Noble, and iBook. For this week, this 400-plus-page book will be released for $.99 through Sunday, August 12.

My YouTube channel will also be running contests. I will be giving away one bitcoin, $100 gift cards, and domain name hosting packages. This is not a funeral. Yes, the stakes are high, but I want to make it fun, too.

What’s one piece of advice you’d like to leave with readers?

Be optimistic in life, but pessimistic when making preparations. If you’re able to do that, you’re going to be in great shape.

Ooh this is all new to me! Thanks for spreading the word Laurie!!

🙂