What would your life look like with no more payments? No more car payments. No more credit card payments. No more student loan payments. How much extra money would that give you? Imagine the freedom to travel, to build your dream house, to finally retire. It’s a new year. And a chance to finally, once and for all, get out of debt. But what if you’ve tried before, and nothing’s worked? Or you’ve gotten out of debt only to get back into debt?

If you’re reading this, you may have an overwhelming amount of debt to tackle. Or you may be a personal finance guru, and need this advice like you need an extra helping of pasta with dinner.

Never fear! This guide is designed to help you get out of debt, but much of this advice will also work for other large, looming goals you’ve set for the year.

But why, you may be asking yourself, should I listen to this random voice on the internet? What does she know about how to get out of debt or how to accomplish my goals?

Our Story

I have written every detail of how Mr. ThreeYear and I managed to get out of debt in this post and this follow up post, but in case you’re new, here’s a recap.

When Mr. ThreeYear and I got married, we were both debt free. This is something of a miracle when most college graduates finish college with debt. According to Tica, The Insitute for College Access and Success, 76% of graduates from New Hampshire, where we live, have college debt upon graduating as undergraduates, and the average debt burden is $33,410. That’s for undergraduate education!

I was fortunate to have scholarships to college and parents who paid the rest. Mr. ThreeYear was fortunate to live in a country where undergraduate education is more reasonably priced: Chile. When we met (in said country), neither of us had any debt. We spent a few years living like the DINKS we were, but Mr. ThreeYear’s way: we bought everything in cash. If we couldn’t afford to buy it with cash, we couldn’t afford it. I scoffed at Mr. ThreeYear as he saved up to buy a car, in cash. “Why don’t you just take out a car loan?” He looked at me like I was crazy. “I don’t want to take out a car loan! I’ll just wait and buy it when I have enough money.”

Two years later, we moved to the States. We moved to the fast and furious city of Atlanta, where Mr. ThreeYear, and then I, found jobs, and slowly, every-so-slowly, we began to adopt the Atlanta way of life. First, we bought a house. We had been renting a very nice, 1100-square-foot apartment that was 15 minutes away from Mr. ThreeYear’s job (it was literally two miles away from us, but you know, Atlanta traffic). It had tennis courts and a pool, and a low rent (we paid around $850 a month for a two-bedroom in the heart of the city), but we decided we should buy a house, instead.

We managed to scrape together a scanty 5% down payment and bought a 1964 split level, an hour away from both of our jobs, on a 30-year mortgage at the height of the real estate bubble (but we didn’t know that quite yet).

We took on other debt, too. We honeymooned in Greece and put that on our credit cards. We bought a bigger car, when I was expecting Junior ThreeYear, this one with a car loan. I started a business, and we put that on our credit cards. Somehow, between moving from Santiago to Atlanta, we’d forgotten the wisdom of waiting until we had the money to buy something. We felt like we’d arrived, now that we were married and had jobs, and we deserved what we wanted now.

We often tricked ourselves into believing that we had to have a particular item right then, or we would suffer. “We need to have a house before we can have kids. How could we raise our baby in an apartment?” As if no child has been raised in an apartment before. “We can’t put the carseat in a 2-door hatchback! We have to have a 4-door SUV for our baby!” Oh, to look back on those decisions now.

By the middle of 2008, we had a new house, a new car, a new baby, and over $38,000 in debt, between car loans and credit card balances (not counting mortgage debt, of course!). Mr. ThreeYear had been laid off in January of that year, but had fortunately found another job right away. It was unsettling enough, though, that we’d started to realize that our financial choices were putting us in jeopardy. If only we had known that he faced another layoff at the end of that year. Maybe I sensed it that day in Barnes & Noble when I saw Dave Ramsey’s book, The Total Money Makeover.

I was browsing the personal finance section. Maybe the cover grabbed my eye. Maybe it was the picture of Dave Ramsey cutting up a credit card that attracted me. Whatever it was, I opened the book up there in the store and started reading. Ramsey’s style was engaging and direct, and I was immediately hooked. I sat down there in the store and read most of the book. Then I bought it, vowing it was the last book I’d buy for awhile, and took it home to share with Mr. ThreeYear.

That night, we started our debt repayment journey. It took 18 months to pay off all our debt, and we did it despite Mr. ThreeYear’s second layoff of 2008, but it started us on journey towards financial freedom that has impacted our lives in the most profound and life-altering ways.

I cannot overstate the impact that getting out of debt and getting control of our finances has had on our lives.

It has affected our marriage, our peace, our children, the jobs we’ve taken, our attitudes about the future.

When you pay off your debt and begin to build your net worth, it begins to positively impact every facet of your life–your wealth, of course, but your health, your friendships, your values, your generosity, your patience, your tolerance, your overall happiness.

The self-discipline and self-esteem that paying off your debt gives you begins to build, like a muscle, and spill over into other areas of your life–your ability to change bad habits, how much you exercise, how you respond to colleagues, how tidy you keep your underwear drawer.

So how in the world did a pair of Average Joes like Mr. ThreeYear and me pay off our debt in just eighteen months? We had no special talents, resources, or gifts. We are NOT frugal people by nature, and tend to overspend if we’re not really careful. We didn’t even know very much about money when we started. But we still paid off the debt. Here is what we did, step by step, to slay our debt monster and start on the path toward financial freedom.

Get Mad at Your Debt

Dave Ramsey talks about getting mad enough at the amount of money that you owe that you’re willing to make a change. Your debt is a yoke around your neck. It is a burden, no matter how little you think about it, that tugs at you, month in and month out, as you send in payments or figure out when to pay your credit card bill so you’ll have some money left in the checking account.

You have to get mad enough at the debt that you’re willing to begin to change your behavior, which is hard. One thing to know about our debt repayment journey: we didn’t magically wake up the next day and figure out how to live more frugally, max out our 401Ks, and sell a bunch of stuff on eBay to radically change our lives. Everything is hard when you start, and you’re bad at it. When you first begin to budget, it feels impossible. It feels like you can’t possibly spend less money than you do now. But you have to persist through those uncomfortable feelings through the time it takes you to figure out new habits and new spending patterns.

Decide that you hate your debt enough that you’re going to kill it, once and for all.

Figure Out How Much Debt You Have

The next step is to figure out your total. This means pulling out every credit card statement you have and totaling up the debt. It means calling the student loan company and asking for the total debt owed. It means calling the car companies and doing the same. Write down how much you owe for each:

- total debt for Credit Card #1

- total debt for Credit Card #2, etc.

- total student loan debt for Partner #1

- total student loan debt for Partner #2

- total car loan for Toyota

- total car loan for Honda

- Etc.

Dave Ramsey’s tried and true method is to put the amounts in order, from least to greatest, on a list. Tape this list to your bathroom mirror, or your fridge, or somewhere else you’ll see it every day. This is the famous Snowball Method.

Your first order of business is to pay off ONE line item–the item with the lowest balance–as fast as you can, in order to show yourself that you can pay off debt (for the rest of the items on your list, you’ll just pay the minimum balance). Then, you’ll use roll the money you used to pay off the first debt into the second debt, creating a larger and larger snowball of funds available for paying off your debt. But where do you get the extra money? Read on.

When you start to engage in behavior that you used to think was impossible–paying off debt, running a mile, eating green smoothies for breakfast instead of pancakes–your brain starts to reprogram its internal dialogue. When you tell yourself, “I can’t pay off debt. That’s hopeless,” your brain answers, “Yes you can, because you’ve done it before. You paid off your entire Kohl’s credit card in just two months!”

Ramsey is very clear that in order to stay out of debt, you have to stop using the thing that got you into debt in the first place. It’s why he’s cutting up a credit card on the front of his book. While Mr. ThreeYear and I were paying off our $38,000 of debt, we cut up all of our credit cards but one. We put the final one in the freezer, frozen in a block of ice, for “emergencies.” (There was never an emergency). We used our debit cards for all our other purchases.

It’s important to note that when you start using your debit card instead of your credit cards, you might not have enough money for the first two weeks. We were using each paycheck to pay the upcoming credit card bill, so when we first started using our actual cash, we had two weeks where we didn’t have enough cash for the upcoming bills.

What we did to solve this problem was delay paying everything until the last possible day, at least for the first month. We usually paid our mortgage on the 5th, but we waited until the 15th. We paid all our credit cards (minimum payments) on the last possible day, and did the same with our water, gas, and electricity. It was very tight at first, but we made it work, and by month two, we were able to use our paychecks for the upcoming expenses.

Get Help

After you figure out how much total debt you have, you need a way to find extra money to pay that debt off. Until now, there’s been no extra money, right? There’s been less than extra money, because until now, you’ve slowly been going into debt.

So chances are you’re going to need help to find extra money. We used a budgeting service to help us. For the first eight years of our financial journey we used Mvelopes and for the past year we’ve used YNAB. YNAB is superior and works really well. YNAB, or You Need a Budget, is a budgeting service. You pay $5 a month for it, but you get the first month free, and if you’re a student, you get the first year free. The service teaches you how to set aside your money into different categories so that when a bill is due, you’ll have enough money in the category to pay it. If you have debt, it helps you budget for those payments, too.

The PROCESS

Remember that learning how to budget, just like learning Chinese or learning how to downhill ski, is a process. It takes time and at first it will be hard. I tell my students this all the time: “It is hard before it is easy. Expect anything new that you do to be hard at first. That’s normal. You have to push through the hard to get to the easy.” The reason is because this new behavior is not automatic. Your brain doesn’t know how to budget. Nothing about the process is automatic. You feel awkward and unwieldy, foolish and silly. These feelings are normal. They’re to be expected. Plan to feel weird and foolish for awhile as you learn to budget. Know that is part of the process.

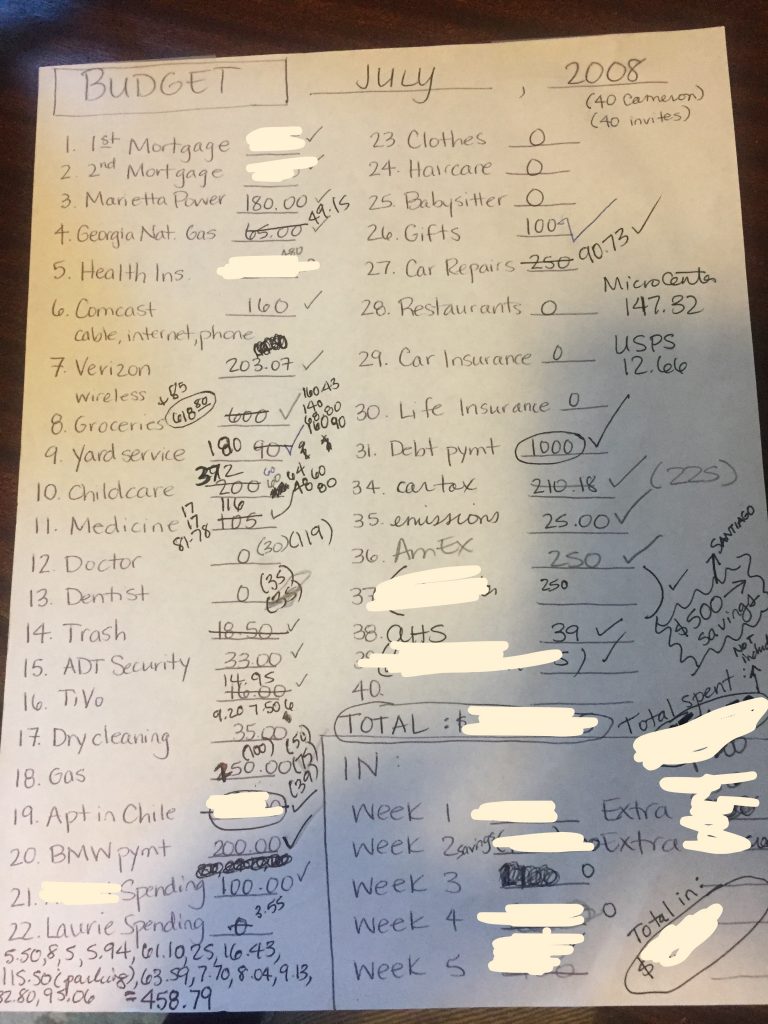

When Mr. ThreeYear and I began to budget in 2008, we had scratches and lines crossed out everywhere. We tried to remember all the categories we needed to budget for, but we forgot about half of them. We also had services then that I laugh about now. It’s taken nine and a half years, and we still spend more than I’d like in certain areas (like food), but we’ve gotten so much better at our spending.

That first budget included lines for our first mortgage, our second mortgage, $160 for our cable, internet, phone package,, $203.07 for wireless!!, $180 for our yard service!! (seriously? this should have been the first non-necessary service to go!), $33 for our security service (ditto), $35 for dry cleaning!, and $372 for childcare (I was a stay-at-home mom so we could have cancelled this as well).

When you complete your first budget, you’re going to simply record what you spend in each area. If you spend $776 per month on exotic ferns, write that down. If you currently spend $432 for your family’s cell phone service, write that down.

You have to track before you can change.

You have to know what you spend before you can get mad or annoyed enough at unnecessary spending to make a change. We had to write down all that unnecessary spending in order to be able to see, with fresh eyes, just how much it was getting in the way of our debt repayment goals.

It may take two, three, or four months to be able to begin to anticipate how much you’ll need to budget in each category, but keep trying. And failing. Because you’re slowly getting better. And you are achieving your goal, no matter how slowly.

Further Reading:

- Guide to Getting One Month Ahead Financially from Six Figures Under

- Setting Up a Budget for the First Time from Reddit

- Setting Up a Budget from Investopedia

Use Visuals

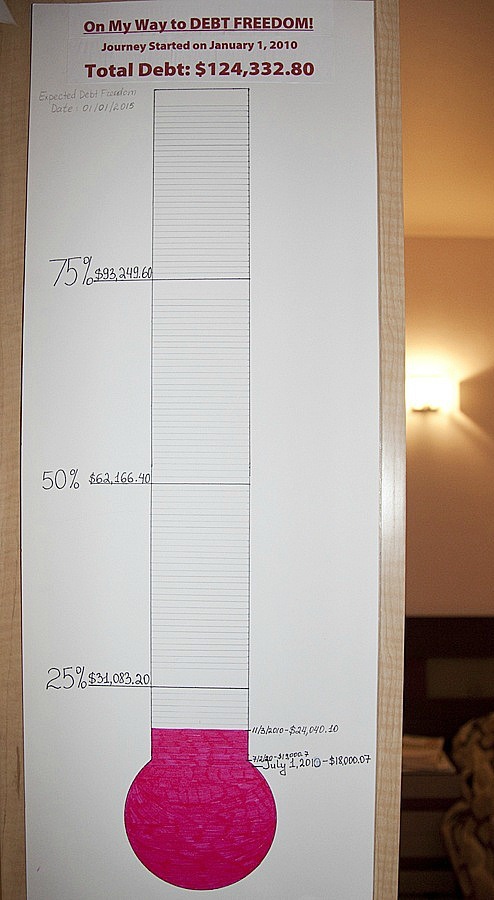

If you put your list of debts on the fridge or your bathroom mirror, I also recommend making a thermometer with your total debt at the top. Then, anytime you pay off some of your debt, you can fill the thermometer in and watch your progress. I’ll admit, when you first start to fill the thermometer in, it feels like you’re so far from the top you’ll never finish. But coloring in those small amounts is powerful, and triggers you to keep pushing through to pay it off. Your brain likes completed loops, so when it sees the large swath of white still to pay off it subconsciously comes up with ways to make that happen.

You wake up and have new ideas for ways to earn more money or new thoughts for what you can sell. Your brain is looking to close the loop, and the visual is a daily reminder of unfinished business.

Visuals are also powerful reminders of your goals. Making a visual of the debt you want to pay off will keep you thinking about it, so your debt isn’t relegated to the back of your mind. Psychology Today notes that the brain is a visual processor, not a word processor, so using visuals enhances our brain’s capacity to absorb information. “Words are abstract and rather difficult for the brain to retain, whereas visuals are concrete and, as such, more easily remembered.” Think about the logos companies use–very often, as is the case with Starbucks and McDonalds, companies only rely on the power of their easily-recognizable visual, and not the name of their corporation. Our brains have already associated their logos and what they sell, so adding their names to the logo is unnecessary. The power is in the visual.

Have Laser Beam Focus

So much of our success and/or failure in today’s modern, fragmented world comes down to focus. It is so easy to become distracted by your phone, YouTube, or the many articles you’re reading on Facebook.

But if you want to successfully kill your debt, you have to stay focused on your goal. When Mr. ThreeYear and I started on our debt repayment, I woke up every day, walked into the bathroom, and saw our big red thermometer. It reminded me to make an affirmation that today I would focus on paying off a little bit more of our debt. I set the intention for the day, and it helped me remember, as I was out in the world spending money, what our long-term goal was.

Mr. ThreeYear and I used dinner to talk about our debt repayment progress. We’d discuss ways to save more money, ideas we had for earning more, and otherwise keep ourselves motivated. We didn’t talk about debt repayment for the entire dinner, but we did check in with each other daily.

The Mirror Trick

An incredibly effective (if a little woo-woo) trick to maintaining your focus is the Mirror Trick, which I got from Jack Canfield. At the end of each day, I walked into the bathroom, stared into the mirror, and talked to myself about the day. First, I told myself what I’d done well that day. I had to think of at least three things that I was proud about. “Self,” I’d say, “I did a good job not going out to Starbucks today when I wanted to. I found extra change in the car and made a Spare Change Jar to help us toward our debt goal. Nice work! I remembered to pay the minimum payment on the AmEx card today so it wasn’t late.” It’s important, as you’re talking to yourself, that you look yourself in the eye. Your brain is picking up on your statements about yourself, and it’s relearning how to send you better thoughts during your day. You’re reminding yourself that you’re doing things right.

The second step is to talk to yourself about what you can improve tomorrow. I would say, “I stopped by Target and bought a shirt. Next time, I’m going to drive past and not stop.” Or, I might say, “I got really frustrated at Junior ThreeYear right after I was worrying about how we’d pay off the car and I yelled at him. Next time, I’m going to take a deep breath and calm down first.”

This trick helps you reprogram your thinking during the day to help you along with your goal. You’ve praised yourself for the things you’ve done well, reminding yourself that there’s a lot you’re doing right, and you’ve gently reminded yourself to change behaviors that aren’t serving you, so that next time you engage in those behaviors you’re more likely to pause and think for a second before starting them. That awareness is the first step toward change.

Further Reading:

- Is Focus More Important than Intelligence?

- The Magical Power of Focus on Zen Habits

- Influence. And the Importance of Focus on Becoming Minimalist

Use Your House to Make $$

So how were we able to come up with the $38,000 in just eighteen months? We used a combination of savings, belt-tightening, and selling big items (like our cars) to come up with more money. How could you come up with extra money to pay off your debt?

There are as many ways to earn extra money as there are websites on the internet. My advice to you is to pick one, and stick with it. Find a pretty good money-making opportunity, and use that to fund your debt repayment. Your money making venture doesn’t have to be perfect. It just has to make you some extra money, relatively quickly (in other words, don’t start a new business that will take years to realize revenue in order to pay off your debt). If you try to start too many side hustles, you’ll lose focus and inevitably make less progress on your goal.

One of the best ways to make extra money is to use your house, if you have one. This will require courage, let me tell you. As someone who is currently contemplating selling her house and moving to a smaller place, you will get a lot of pushback if you do something that is against the norm. But there are many ways to utilize your home for extra $$$.

Sell your house & rent a smaller place

One thing you could do, if you have any equity in your home (or even if you don’t!) is to sell your house and rent something smaller. Not only would you probably save in monthly mortgage costs, you’d save on property taxes and maintenance. We don’t realize how much we spend in maintenance on our homes until we start to track it. In 2016, a year where we had no major maintenance issues, we spent $2,118. If we were renters, we would probably have spent less than $100 (if anything).

Granted, moving costs money. But if you were to sell your house and walk away with $50,000, then you could put that towards your debt and start saving for another house downpayment while you rent.

This handy calculator from The New York Times shows you that renting isn’t really the bad deal people make it out to be. For us, it would have taken 15 years of renting to be a worse deal than buying a house. 15 years!

AirBnB your house

Do you have a basement level, like we do, with a bathroom and separate entrance? You could rent it out on AirBnB, especially if you live near a city or a major attraction (like a national park or a ski resort).

Take a roommate

You could also take a roommate for a little while. No, it’s not ideal, but if you’re looking for a fairly low-effort way to make money, here’s one. Some of my heroes in saving and investing money, like Paula Pant of Afford Anything, had roommates for years. Paula made over $40,000 in two years without “lifting a finger” by having roommates.

Make sure to get personal references and check them when you’re choosing a roommate. Pick carefully, and set ground rules. In our area of the country, though, where rents are high and rental units are scarce, this is a great way to make extra money and add to your debt payoff pool.

Be Patient

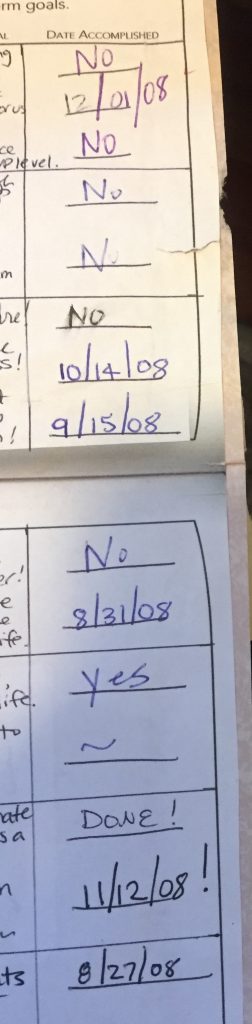

Never underestimate the power of writing something down. I’ve changed so much of my behavior by writing down goals, and not achieving them. That’s right. I usually only achieve about half of my goals in a given year.

Last year, I set the goal of earning $100/month with my blog. I didn’t do anything last year to achieve my goal. Maybe I was scared. Maybe I wasn’t ready. Maybe I was too busy. I don’t know. In 2017 I earned $0 from my blog.

But I wrote the goal down again this year. And now I’m ready. I’ve started the process of earning money through writing, of starting my freelance business. I don’t know what changed. But something did. And because I kept reminding myself that I wanted to eventually earn money from writing online, I set it as a goal again this year.

I had to be patient with myself last year. I didn’t berate myself for not achieving my goal. I’ve set goals for long enough that I now know that I won’t achieve some of them during the first year. But if I’m patient, and try again, chances are very good that I’ll achieve them in Year Two or Year Three.

The same is true with every step of your debt payoff. You may not succeed in budgeting the first month. Or the second. Or the third. Maybe you’ll only manage to pay off $10 extra toward your debt the first month. Or $100. But those small wins, those new habits, will begin to reap rewards in your debt payoff journey. You will make progress, even if it’s slower than you like.

It took Mr. ThreeYear and me eighteen months to pay off $38,000 in debt. A year and a half. That’s an average of just over $2,000 per month in debt repayment. We weren’t able to pay that much in the beginning. But gradually, through tightening our belts, the debt snowball, some selling things off and some gifts, we were able to pay everything off. Our progress was often slow. It often felt never-ending. But amazingly, we paid off all of our debt and started to create a positive net worth.

And less than ten years later, we have a substantial net worth, we’ve saved up for our kids’ college educations, and we’ll be able to retire in just a few more years (if we choose to). If you had told me at the beginning of my debt payoff journey that I’d be where I am today, I’m not sure I’d have believed you. Or I would have thought I’d be where I am through some business gain. But I certainly wouldn’t have believed that slow, steady saving and investing would have created the net worth that we have now, in such a short time.

Rinse and Repeat

Once you’ve mastered the art of budgeting, the hard part is sticking with the process. Most of your debt payoff will be boring. For us, the only exciting parts were making extra payments, crossing debts off our list, and adding to our thermometer.

But the relief that paying off your debt gives you, and the subsequent freedom, is worth the slog. It’s worth the boredom. It’s worth the sacrifice.

After you’ve paid off your debt, you’ll be able to enjoy the unparalleled feeling of being debt free. Your money, instead of going to pay your creditors, will go to you. You can save it and invest it. It will grow faster than you ever imagined, since you’re free of payments and free of interest.

So what are you waiting for? It’s time to be debt free!

Great story and advice here Laurie. It’s similar in some ways to mine, although my motivation for getting out of debt was different. I also used Dave Ramsey as motivation for my debt free journey, and I had mine wiped out in under a year. Once you have no more payments it’s amazing how your net worth increase is supercharged. I’ll tell you, though, I struggle at times with the mortgage payoff goal. It’s so huge and long term with so few small rewards that it can get frustrating!

Thanks Liz! Wow–you paid off your debt in one year. Nice job!! Yes, I hear you about the mortgage payoff. It’s such a big number and it can feel like such an uphill battle paying it off! Maybe we should draw ourselves a thermometer?! 🙂