Pardon me for not writing about this back in June when it actually happened, but we doubled our net worth. That was one of two giant goals I had on this blog when I started it.

I think I told you that we went out to a fancy dinner to celebrate.

The dinner was anti-climactic, in part because of Covid restrictions.

The reaching of our goal, however, has left me happy. Every time I check our net worth I’m happy. Especially because it keeps going up.

I know, I know. Major bull market; we’re undoubtedly in for a major correction. But let me enjoy it while it lasts, ‘kay?

How did we get here? Well, let’s back up. I wrote a post back in October of 2017 called How We Plan to Double Our Net Worth.

Basically, we planned to pay down our mortgage principal, save money in our retirement accounts, and add money to our taxable accounts.

Here is our total net savings rate over the past three years:

| 2017: 42.09% |

| 2018: 31.37% |

| 2019: 45.38% |

You’ll notice we didn’t manage to save 50% of our incomes over the past three years. We’ve actually never hit the 50% savings rate. But, because we started investing early (we invested about 20-25% of our incomes when we first started working, even as we were accumulating lots of debt), we didn’t need to.

Our savings rate so far for this year has been 53.78%. We know that will go down for the total year, since we have decided to put both Junior ThreeYear and Little ThreeYear in the private school where I work. I do get a tuition break, but it’s still a lot of money. But, hey, because of all the past savings, we get to do this thing for our kids during a Covid year, so they can go to school in-person (with masks, and six feet distances, and 10-people classes, etc.).

Drum Roll, Please…

We officially doubled our net worth in June of 2020, which was six months later than our goal of December 2020.

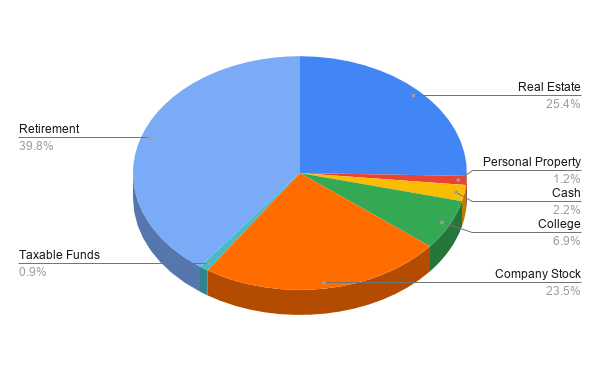

Here is the breakdown of our assets.

Our real estate is the equity we have in our home plus the equity we have in our paid-off apartment in Chile. We had originally planned to bulk up our taxable funds this year, but due to a scare Mr. ThreeYear had with his job earlier in the summer, we are instead bulking up our emergency fund. I suspect we may then decide to divert some funds into our taxable account later in 2021.

We have a way to go until I’m comfortable retiring, especially since most of our assets are tied up in retirement funds, but I feel pretty good about where we stand right now.

Sometimes I think that we didn’t do anything particularly notable to get here. Then I look around me and remember that the size of our nest egg is rare around these parts. I have a feeling that most of our neighbors spend it all plus more. Not sure, but that’s my guess.

We definitely did some things right and some things wrong to get here.

The Smart Stuff

We invested early.

We didn’t graduate college with debt (that was my scholarship + privilege and Mr. ThreeYear’s going to a cheap Chilean college and paying his own way for grad school).

We bought less house than we could afford on a 15-year mortgage.

We drove old cars.

I wish I could say we kept our grocery budget low, but that would be a lie. August was the first month we stayed under $600 in a loooong time. But since I spent the summer binge-watching YouTubers on how to keep it low, I think I’ve figured out some tricks.

So I guess that’s another one: we kept/keep working at spending less until we do actually spend less.

We max out our 401ks. Or, Mr. ThreeYear does and I did until we decided to send my kids to private school.

Basically, we did/do a lot of things to trick ourselves into savings, like having a 15-year (then 10-year) mortgage, maxing out retirement, and automatically sending money to kids’ college funds and savings each money.

Incremental Gains

I know that a lot of our strategy has involved incremental gains. I started out really bad at budgeting and managing money. But I knew we needed to be investing for retirement. So I started there.

We implemented that habit into our lives, all while racking up debt and doing other wildly stupid young person stuff like blowing our cash on the latest Sony Discman (I know, we’re sooooo old).

But then, we figured out we needed to pay off our debt. And not take on new debt.

So we did that. And to do that, we had to spend less, and cut out expenses like our alarm system, housekeeper, yard service. Geez, high maintenance, much?

And then we saved up a little in an emergency fund.

And then Mr. ThreeYear got a more secure job and we moved.

Then we bought a new house with a 15-year mortgage.

Then we started saving more for retirement in his 401k.

Then I got a job and we started saving up more for retirement.

Then we started saving more for the kids’ colleges.

Et. cetera. Et cetera.

Our progress definitely wasn’t a straight line. We aren’t necessarily good at this stuff. We are just persistent AAGO (as all get out. This is a family blog, ok?).

Do you want to hear the stupid stuff we did? I feel like that wouldn’t be helpful.

Just rest assured, we did tons of stupid stuff.

Despite the stupid stuff, we reached our goal. And the best part? Our net worth will continue to increase, and double, and double again (maybe) because we now have good financial habits. We also have momentum.

This Is Just to Say…

With a nod to William Carlos Williams (I was an English major in college), this is just to say that I am grateful to you for reading and following along. Thanks for your insightful comments that have helped me learn and get better. Thanks for your enthusiasm and encouragement. Thanks for your interest.

This month marks my FOURTH YEAR blogging! What?! I’m not so prolific as I used to be but I’m still going (there’s that persistence again). Maybe one day I’ll actually monetize this thing? I don’t know. She’s my passion project.

I appreciate you reading. Thank you, thank you.

Woohoo, congrats Three Year Fam!

Awesome pic of you all at the top, love the smiles!

Thank you Amy! We were bowled over by that photo–all four of us were actually smiling at the same time. Ha!

Congratulations for hitting such a big goal. I have enjoyed following along with you as you figure out what works *for you* and not being 100% successful 100% of the time. I hope you will still find some time to blog going forward, some of your posts have really resonated with me (as I am sure they have with others).

Many thanks! I love to write, so I’m hoping now that I’ve gotten a better handle on school, that I’ll be able to publish more.

Congratulations on hitting your goal! I have really enjoyed following along as well. Love the tips!

Congratulations! I’m a long time reader and so happy for you guys. I have enjoyed following your journey.

I really appreciate it! And I appreciate you reading all this time! 🙂

Thank you Danielle!

Congratulations!! So exciting to hit that big milestone!

Thank you Sarah!!!

Hey, Congrats Laurie! That’s a big accomplishment!

Thank you!

posting in an attempt to subscribe to blog. option at top right does not seem to work.

You are subscribed. Thanks for following! 🙂